At the beginning of 2023, the experts from the Capital Markets department of Deltastock present their expectations for the major global currencies in the first half of 2023.

The current analysis is a basic scenario for the development of the major currencies in the first half of 2023. Alternative scenarios are not a subject of this article.

Since the topic is expansive and complicated, we will create an algorithm with which we will rank quickly and clearly the expected relative strength of the major currencies in the period in question. We will be using only publicly available data in order to minimise our own interpretation. The end result of the algorithm is obtained by adding the products of the weight of each factor and the ranking of the currency relative to it.

Thus, the lower the result, the higher the likelihood of good performance in the first six months of 2023. The evaluation factors with equal weight (approximately 16.67%) are six, as we are seeking the main trend for the six months and not the highest possible precision of the current analysis.

The factors we will take into account and rank the currencies in accordance with are:

Real interest rate. The higher the actual interest rate of the respective currency, the higher the expectations of it performing better. This percentage is calculated by subtracting the latest annual inflation data from the current yield of the ten-year government bonds of the respective country.

- CHF -1.449 %

- JPY -2.362 %

- NZD -2.825 %

- USD -3.32 %

- AUD -3.46 %

- CAD -3.625 %

- GBP -7.06 %

- EUR -7.61 %

Source: www.tradingeconomics.com

Inflation expectations. According to the Purchasing power parity theory, under the same conditions, the higher the inflation expectations (in our case, on an annual basis), the weaker the respective currency in the medium term.

- CHF +1.551%

- JPY +2.7%

- NZD +3.6%

- EUR +5%

- AUD +5.2%

- USD +5.2%

- GBP +6.1%

- CAD +7.11%

Source: www.tradingeconomics.com

International trade. This is a measure of the relative value of a given currency. It measures the ratio between the value of exports in national currency and the value of imports in foreign currencies. This measure is of medium term nature and is not of homogenous composition for the various countries, but has the same concept. The higher value of the trading conditions means that a given volume of exports in local currency can pay for a higher volume of imports in foreign currencies.

- NZD 144

- AUD 135

- USD 115

- CHF 106

- CAD 99.6

- GBP 88

- EUR 88

- JPY 73.1

Source: www.tradingeconomics.com

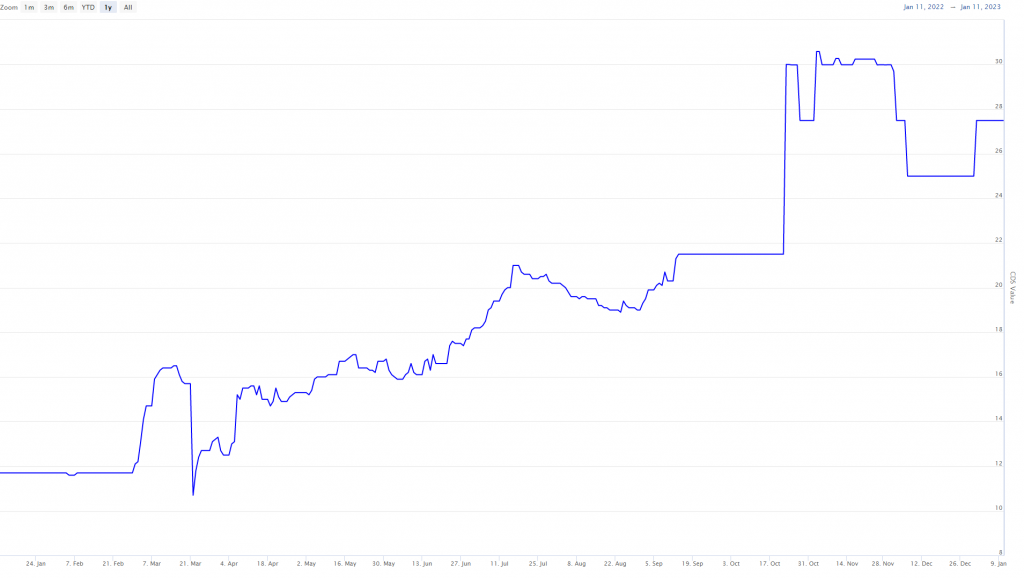

Risk Premium (CDS). In our case for risk premium we accept the value of the so-called credit default swaps of the sovereign debt of the respective country for a five-year period. The higher value (in basis points) means higher risk.

- CHF 7

- GBP 6.82

- EUR 7.50

- JPY 17.2

- USD 25

- AUD 35

- CAD 39.24

- NZD 135

The below chart shows the price performance of the credit default swap of the U.S. government bonds for a five-year period, which is the most liquid segment of the CDS market.

Source: https://www.worldgovernmentbonds.com/sovereign-cds/

Expected profitability of investment opportunities. Here we use the latest IMF forecast for the annual growth of the real GDP for 2023 of the respective countries.

- NZD +1.9%

- AUD +1.9%

- JPY +1.6%

- CAD +1.5%

- USD +1.0%

- CHF +0.8%

- EUR +0.5%

- GBP +0.3%

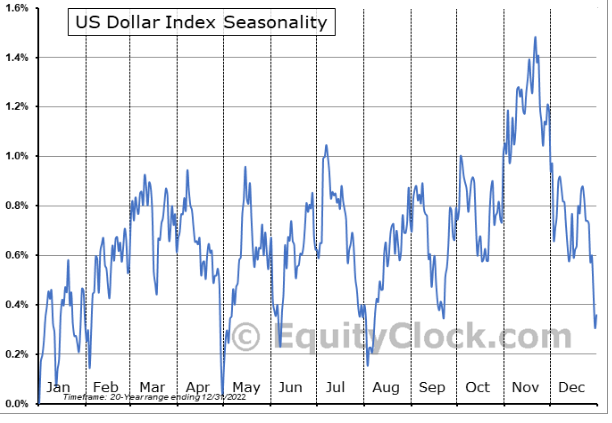

Seasonality. This is the typical change in percent for the first six months based on the historical performance of the futures on the respective currencies for the last 20 years.

- AUD +2.0 %

- CHF +1.7 %

- CAD +1.6%

- NZD +0.7 %

- EUR +0.6%

- GBP +0.4 %

- JPY +0.4 %

- USD -0.3%

The below chart shows the typical (average) price performance of the futures on the dollar index for a 20-year period.

Source: https://charts.equityclock.com

The end result for the expected relative strength of the major currencies for the first half of 2023 is as follows:

- CHF (relatively the strongest currency)

- NZD

- AUD

- JPY

- USD

- CAD

- EUR

- GBP (relatively the weakest currency)

In conclusion we would like to point out that the global risk zones for the first half of 2023 would most likely be China (Covid-19 epidemic and debt implosion), Japan (unexpected decisions of the Bank of Japan and political uncertainty) and Ukraine (the war with Russia).

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

76% of retail investor accounts lose money when trading CFDs with this provider.