Source: Dreamstime | Author: DeltaStock

Reading time: 6 minutes

First came the global pandemic. Now, a full-scale war not seen in nearly a century threatens to repeatedly shake the global economy to its core, and yesterday’s bullish markets have ventured deep into the red. Doom and gloom forecasts aside, there are still plenty of strategies that traders could employ to take advantage of today’s unstable price movements.

One such strategy is called short selling.

What is short selling?

If you paid attention to any of the news in recent months, then you’ve probably heard phrases like “going short” on assets or people engaging in “short selling”. So what does it all mean and why do you hear it now that the markets are seemingly on the brink of collapse?

In essence, there are two main ways in which traders can go short on their markets of choice: through borrowing assets from a broker and through financial derivatives, such as CFDs (Contracts for Difference).

Traditional short selling

In the first scenario, traders short sell by borrowing assets from their financial broker (think of it as a loan), which they then immediately proceed to sell at the current market price in the hopes of later buying them back at a lower price and profiting from the price difference. The idea here is simple: if the market declines as you predicted, you turn a profit, if not – you would have to pay the higher price in order to repay your debt and incur a loss.

That being said, traditional short selling has one significant disadvantage – it hinges on the promise that the broker has any assets to lend you in the first place, which is not necessarily always the case, especially during highly volatile market conditions. You could also run into “unborrowable stocks” – assets that, for one reason or another, no broker is willing to lend you, forcing you to reevaluate your current strategy or abandon it altogether.

Short selling via CFDs

With CFDs, you don’t need a broker to hand you down assets in order to sell them – instead of the actual asset, you trade the difference in the asset’s buy and sell price from the moment you’ve opened a position to the moment you’ve closed it. Here is how it works at a glance.

Imagine that you wish to sell some Apple stock, which is trading at a current market price of $100 a share. If you decide to short 100 shares and the price ends up falling by $10, you could close out your position and make a profit of $1000 ($100 – $90) x 100).

Due to this simplified trading model, you could trade CFDs on a variety of markets: from forex, popular shares, indices and precious metals to more specialised financial instruments, such as commodities, futures, ETFs and leading cryptocurrencies. Another advantage is that most CFD brokers, DeltaStock included, also offer free demo accounts loaded with virtual money to help you painlessly learn how this whole concept works in practice and in real market conditions.

The best part? Opening a practice account takes less than two minutes.

OR

Reasons to go short

There are two main reasons why a trader would want to go short. One typical case is when they want to “hedge” their investment portfolio, meaning that they take short positions in order to compensate for any potential losses that could affect their long-term investments. If done right, even if the markets eventually force traders to close out their long positions at a loss, they could still make up for some of that by buying back the shorted assets at profitable rates.

Another popular short selling tactic used by traders is to speculate on what they consider to be overpriced assets and patiently wait for the bubble to burst in order to buy them back at a way lower price. In both cases, however, executing a successful short selling strategy takes some careful planning and also involves a mixture of technical and fundamental analysis in order to properly identify “shortable” companies and upcoming downtrends.

Just starting out? Learn the market fundamentals for free with our interactive trading lessons.

Are there any risks of going short?

Like most strategies, short selling doesn’t come without its faults. For one, short sellers potentially stand to lose an unlimited amount of money as, unlike the long positions that are typically more stable, the prices of shorted assets can rise indefinitely – and so can the losses. Particularly unlucky sellers can also find themselves wrapped up in a so-called short squeeze event. This is when a shorted asset has risen so sharply that, as traders rush to close out their positions all at once, they only further put pressure on the market, “squeezing” the price and amplifying the losses.

The good news is that all of this can be easily avoided if you have a good risk management strategy in place. One good habit, for instance, is to place pending orders, such as stops and limits, in order to automatically close out your positions once they pass over or under a certain price threshold. If you’re investing in stocks, another thing you could do is to carefully read through all earnings reports from your favourite companies. This would allow you to better judge their financial situation and to therefore call out any price surges well in advance, giving you enough time to close out your positions while you’re still making a profit.

How to open a short position in our platforms

When you short-sell a CFD, you open a position to ‘sell’ the asset. Both Delta Trading and MetaTrader 5 offer simple ways of buying or selling any type of asset. All it takes is choosing an instrument, adding it to your list of favourites, and clicking on “Sell” to place a short-sell order.

Pictured: the buy/sell terminal as seen on MT5 (left) and Delta Trading (right)

Congratulations – you’ve just opened your first short position, which could net you profits for as long as you close out the position while the asset’s price is still in decline. One thing to keep in mind here is the “spread”, or the difference between the “Buy” and “Sell” prices. Once you decide to close out your short position, the amount of money you will receive will be equal to the difference between both prices at the time of closing.

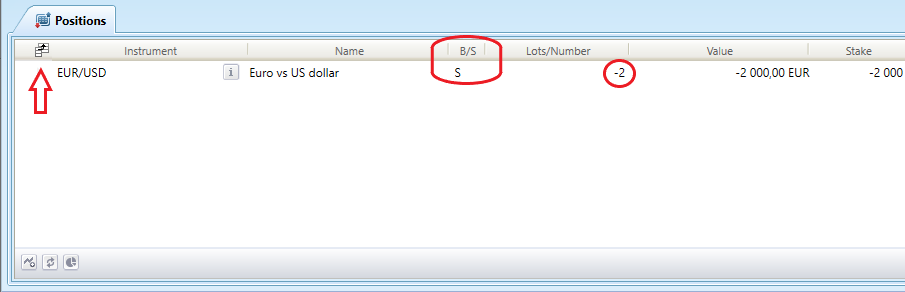

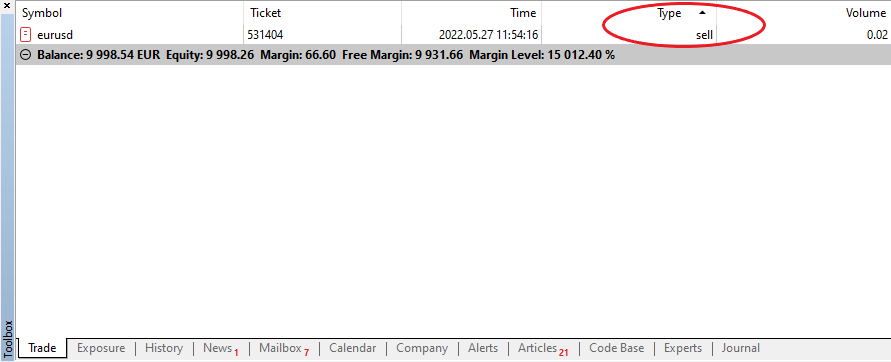

To confirm that you’ve placed a short position, as well as to check its value and other useful information, visit the “Positions” panel in Delta Trading (called “Trade” in MetaTrader 5).

Pictured: the Positions panel in Delta Trading showing an active sell order

Tip: If the B/S (Buy/Sell) column isn’t immediately visible when you first open the panel, you can enable it from the filter icon to which the red arrow is pointing. In addition to the B/S row, another thing that indicates that you’ve opened a short position in Delta Trading is the negative lot amount (-2).

Pictured: the Trade panel in MetaTrader 5 showing an active sell order

In conclusion

If used right, short selling can be an invaluable hedging and price speculation tool. In addition, the current market instability has created some very interesting short selling opportunities that would probably not have been accessible under more normal conditions. However, each trader is only as good as their research skills and their ability to keep their cool in stressful scenarios. Throw in some working knowledge of the market fundamentals, appropriate risk management tools and some consistent practice, and you will have everything you need to become a successful short seller!

***

Master the art of short selling. Open a free demo account with virtual €10,000 (up to €100,000 in MetaTrader 5) and test your strategies in a real market environment, without any risk of losing actual money. Choose from over 1000 financial assets as CFDs and start trading today!

OR

Disclaimer: This article is for information purposes only. The information herein provided does not constitute a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in this article, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page. Deltastock AD shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealised gains that may result.