The “Magnificent 7” – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla – have been the darlings of Wall Street for the past few years. Their dominance in technology and their massive market capitalization have made them key drivers of the S&P 500’s performance. In 2024 they gained 63%, after rising more than 75% the year before. But will their reign continue in 2025?

Analyst Expectations:

While the Magnificent 7 delivered impressive returns in 2024, their growth is expected to moderate in 2025. This is partly due to the law of large numbers, as it becomes harder to maintain high growth rates for companies that are already massive. Additionally, some analysts believe that the AI boom, which significantly boosted these companies in 2024, may start to cool down.

However, the overall outlook for the Magnificent 7 remains positive. They are still expected to outperform the broader market, driven by their strong fundamentals, innovative products and services, and dominant market positions.

*Data valid as of June 2024

Here’s a closer look at each company:

Apple (AAPL): Despite a 30% increase in share price during 2024, Apple’s revenue remained flat compared to two years prior. In May 2024, the company authorised a $110 billion stock buyback, the largest in U.S. history. Analysts are monitoring the impact of potential declines in iPhone sales, particularly in key markets like China.

Microsoft (MSFT): Microsoft’s expansive reach across software, cloud computing, and AI positions it favourably for future growth. The company is making significant investments in emerging fields like quantum computing. Analysts’ price target estimates are for a minimum of $425 and a maximum of $650, reflecting confidence in Microsoft’s long-term prospects.

Alphabet (GOOGL): Alphabet’s focus on AI and cloud services continues to drive its growth strategy. However, recent earnings reports indicated a slowdown in cloud revenue growth, which has raised concerns among investors. The company is expected to continue investing heavily in AI infrastructure to maintain its competitive edge.

Amazon (AMZN): Amazon plans to lead AI investments with over $100 billion allocated for infrastructure in 2025. Despite impressive earnings, the company faced stock declines due to slight misses in cloud revenue targets, indicating a slowdown in growth. Significant capital expenditures for AI data centers are expected to impact profits in the near term, but its fundamentals remain strong.

Nvidia (NVDA): Nvidia remains a key player due to high demand for AI applications. Despite some setbacks, analysts continue to favor the company, citing its dominance in the AI chip market. The average analyst price target for NVDA stock is $172.48, suggesting potential upside from its current price.

Meta Platforms (META): Meta shares reached record highs following a positive quarterly earnings report and optimism about AI growth prospects. The company’s shares have surged 20% since the beginning of 2025, making it the top performer among the Magnificent Seven. Analysts estimate an average price target of $717 and a maximum of $935.

Tesla (TSLA): Tesla’s performance is influenced by various factors, including CEO Elon Musk’s role with President Donald Trump and potential policy changes affecting electric vehicles. Analysts are cautious about the company’s outlook, considering potential challenges such as the reduction of tax credits for electric vehicles.

Yet, despite their strong positions, the “Magnificent 7” face their risks and challenges:

- High Valuations and Market Concentration:

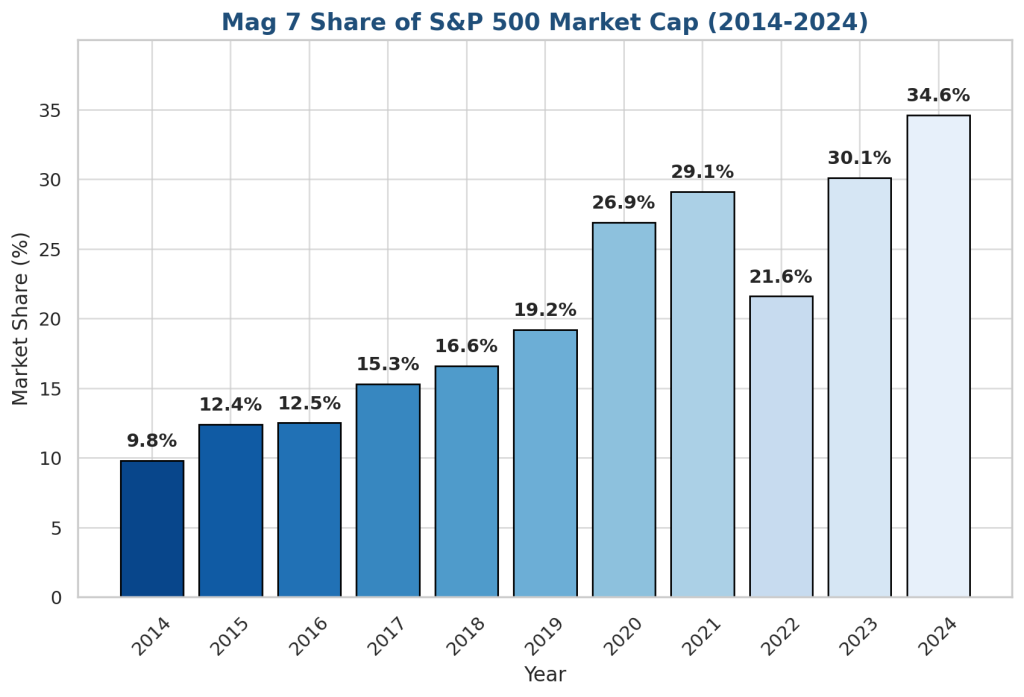

These tech giants have experienced substantial growth, leading to elevated valuations. This concentration raises concerns about market stability, as any downturn in these stocks could significantly affect broader indices. Analysts suggest that the high spending-to-sales ratios, particularly due to investments in AI, may increase risk.

- Heavy Investments in AI:

While AI presents growth opportunities, the substantial capital allocated to AI initiatives may pressure short-term profitability. For instance, Amazon plans to invest over $100 billion in AI infrastructure in 2025, which could impact near-term profits.

- Slowing Revenue Growth:

Recent earnings reports indicate that, for the first time since 2022, these companies did not collectively surpass sales expectations. This trend suggests a potential deceleration in growth, prompting some investors to consider reallocating assets within the tech sector.

- Regulatory and Competitive Pressures:

The “Magnificent 7” face increasing scrutiny from regulators concerned about their market dominance and data practices. Additionally, intensifying competition in areas like cloud computing and AI could erode market share and profitability.

- Market Volatility and Investor Sentiment:

The high valuations and significant market influence of these companies contribute to market volatility. Investor sentiment can shift rapidly, especially if earnings reports disappoint or if there are concerns about the sustainability of their growth trajectories.

In summary, while the “Magnificent 7” have been pivotal in driving technological innovation and market gains and are still a dominant force in the stock market, they must navigate these challenges carefully to maintain their leadership positions. And despite the overall outlook remaining positive, with most analysts expecting the companies to continue to deliver strong returns in 2025, some caution is advised.

Deltastock offers you the opportunity to trade in CFDs on the shares of the Magnificent 7 companies, at exceptionally attractive conditions. Take advantage of them now!

These materials are for information purposes only. They do not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

56% of retail investor accounts lose money when trading CFDs with this provider.