Welcome to this week’s edition of our weekly financial analysis! As we navigate through the financial landscape, we’ll focus on key events that could impact the markets and your investment strategy. Here’s what we’ll focus on this week:

U.S. Inflation Data: CPI and Market Expectations

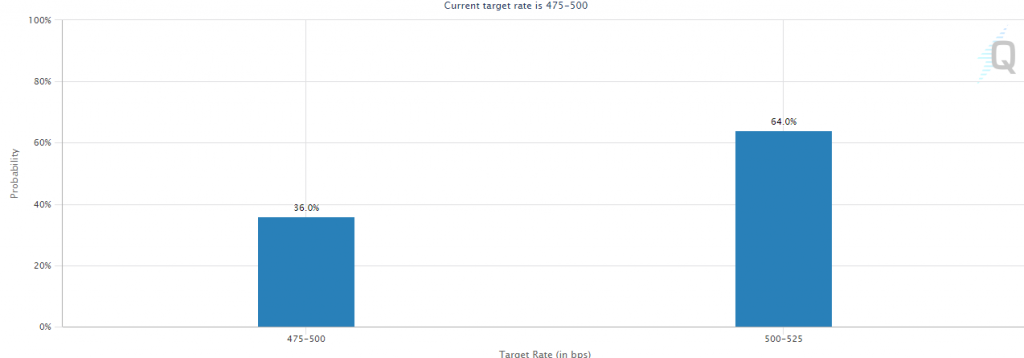

On Wednesday, the release of March’s inflation figures will provide insight into whether price pressures have subsided enough to dampen the Federal Reserve’s appetite for aggressive rate hikes. Economists predict a 0.4% month-over-month increase in core consumer price inflation, translating to an annual rise of 5.6%. The recent U.S. jobs report which showed persistent labour market tightness, bolsters the likelihood of another rate hike during the Fed’s May 2-3 policy meeting. However, what needs to be noted is that 47,000 of the NFP are government jobs, bringing the actual number lower. The current odds for a 25 bps hike, according to CME, are 64%, as you can see in the chart below:

Source: CME FedWatch Tool

Federal Reserve Minutes: Insights into Future Monetary Policy

The minutes of the Fed’s March meeting, set for release on Wednesday, will offer valuable insight into officials’ perspectives on the financial system and their willingness to pursue further policy tightening. Although the market anticipates rate cuts before year-end, the Fed has indicated its intention to maintain elevated rates as needed. Speeches from several Fed officials, including John Williams, Patrick Harker, Neel Kashkari, and Thomas Barkin, will be closely scrutinised.

Bank Earnings: Health of the U.S. Banking Sector

Investors will gain insight into the U.S. banking sector’s health following last month’s crisis, which resulted from the collapse of two mid-sized lenders. Major banks, including JPMorgan, with expected EPS of 3.4, Citigroup with expected EPS of $1.67, Goldman Sachs, Morgan Stanley, and Bank of America, are scheduled to report their Q1 earnings in the coming weeks. According to Refinitiv data, S&P 500 financials are expected to post a 5.2% YoY earnings growth, while overall S&P 500 earnings are predicted to fall 5.0%.

IMF Forecasts: Global Economic Growth Outlook

The International Monetary Fund (IMF) will release its updated global economic growth forecast on Tuesday during its Spring meeting, amid concerns over high inflation and financial stability risks. Central bankers and finance ministers will convene in Washington, D.C. on Monday, with the G20 group of finance ministers slated for talks on Wednesday.

Central Bank Updates: Bank of Canada and Bank of Japan

The Bank of Canada’s policy-setting meeting on Wednesday is anticipated to leave rates unchanged, despite indications of economic strength. Meanwhile, Kazuo Ueda will succeed Haruhiko Kuroda as the Bank of Japan Governor on Monday. Investors will be eager to glean policy hints from his inauguration speech.

Key Economic Data: PPI and Retail Sales

On Thursday, keep an eye out for the release of the Producer Price Index (PPI) data. The previous value was -0.1%, and the figure is expected to rise to 0.1%. This data is essential for understanding inflation trends and their impact on businesses. Additionally, on Friday, retail sales data will be released, with the previous and forecasted values both at -0.4%. These figures provide insights into consumer spending patterns and can influence economic growth projections and will provide further clues on whether the Federal Reserve will continue to hike the interest rates.

Tensions in the Taiwan Strait: Monitoring the Standoff Between Chinese and Taiwanese Warships

We are closely following the developments in the Taiwan Strait after the recent standoff between Chinese and Taiwanese warships. Heightened tensions in the region can have ripple effects on the global economy and financial markets, particularly if they escalate into a broader conflict.

These are the key events and topics we’ll be exploring in this week’s newsletter. As always, our financial experts are here to provide you with in-depth analysis and actionable advice to help you navigate the ever-changing financial landscape.

We hope you enjoy this week’s edition and please feel free to reach out with any questions or feedback.

Ivailo Chaushev

Chief Market Analyst at Deltastock

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

73% of retail investor accounts lose money when trading CFDs with this provider.