Author: DeltaStock

Reading time: 8 minutes

Regardless of how long you’ve traded on the markets, it’s very likely that at some point you’ve heard about the so-called “scalpers” – a breed of traders who earn their bread by going through a series of small winning trades on a frequent basis. If you’re looking to find out if this popular trading method is the right fit for your needs, then simply keep on reading.

What is scalping (and why do traders love it)?

As we hinted above, scalping is a trading strategy that involves the quick opening and closing of short or long positions as soon as each trade turns profitable. Essentially, scalpers earn money by pocketing these small price differences, which accumulate over time. This means that they often engage in dozens of tiny trades in a row, which requires a mixture of keen market insights and a strict trading schedule.

Think of scalping as an elaborate “hit and run” strategy — instead of holding assets over prolonged periods of time, trades are closed as soon as they start bringing in money and new trades take their place until the trader is happy with the end result. If done right, a good scalper could potentially earn more in a day’s work than they would if they simply held long positions.

Scalping versus other trading methods

If you’re familiar with other popular trading styles, then you know that each of them is fundamentally different and caters to a specific trader type. The same thing can be said about scalping as well, which is built around one simple idea – to prioritise smaller market moves over larger ones as they are generally easier to time right and therefore could be more profitable.

One of the main reasons why scalpers go through the trouble of splitting a regular trading session into dozens of micro sessions is to lower their risk exposure. Since the time spent on each trade is so short, there’s a low chance that a scalper could be affected by a huge sudden swing in the asset’s price. Another advantage here is that it takes less time to predict the direction of shorter moves as opposed to making longer-term forecasts.

What are some of the best scalping strategies?

Scalping can at times get a bit technical, so it’s important to get acquainted with at least some of the more popular market analysis tools out there. Below, we’ll share four of the most frequently used tactics that scalpers follow to quickly identify good market entry points.

Scalping trading tactic #1: the stochastic oscillator

This indicator measures market momentum and is used to predict when a price trend is about to end. Stochastics values show us when an asset is overbought or oversold and range from 0 to 100. For example, values under 20 suggest an overbought market, while values over 80 indicate an oversold market.

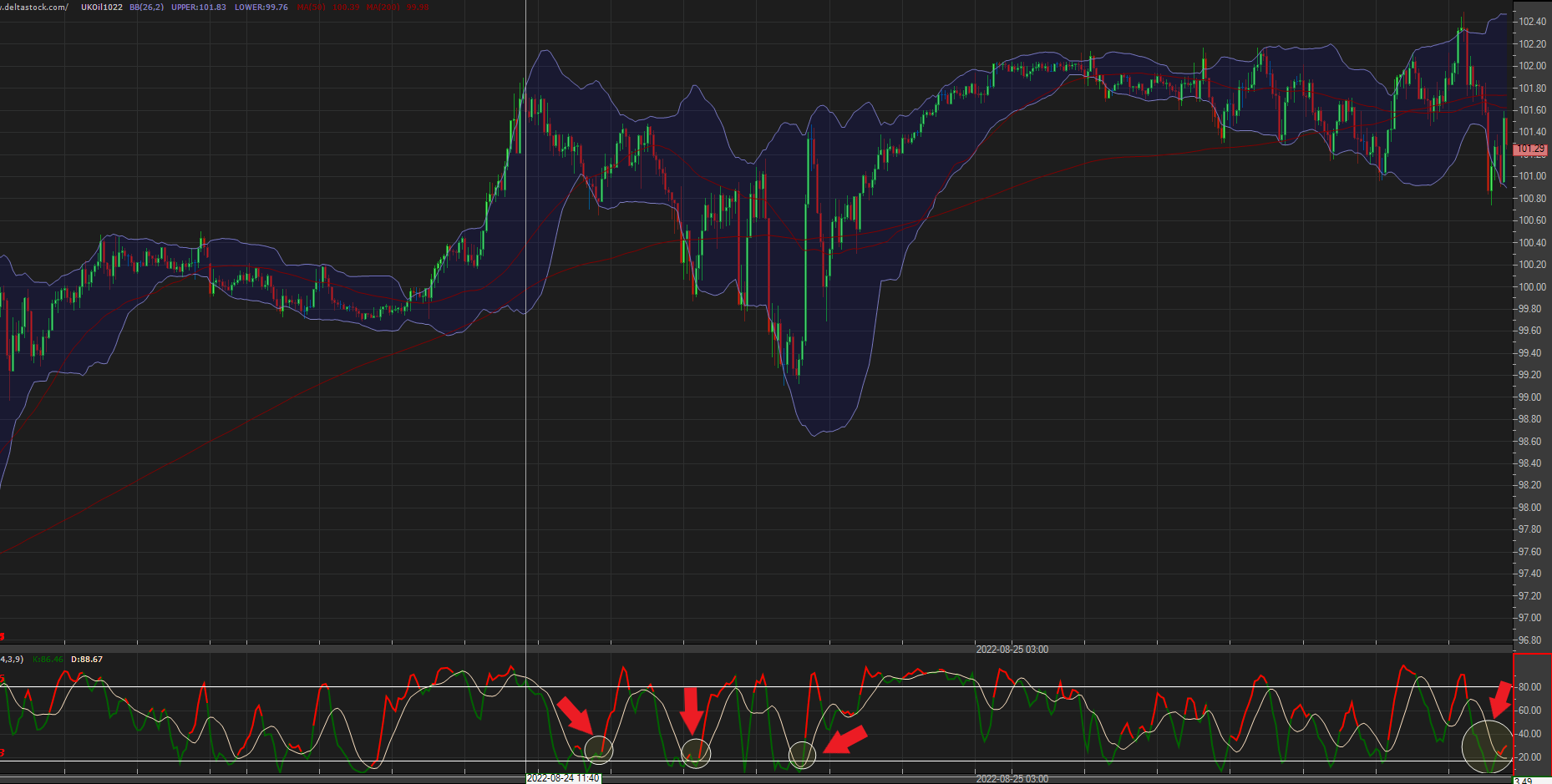

In the context of scalping trading, we can use this indicator to look for patterns in a trending market, in other words, to determine if it is frequently dipping and rising or if what we see is a one-time event. If the market is turbulent, it typically tends to reach both extremes of the 20/80 range set by the stochastic oscillator, as shown in the price chart below.

Source: Delta Trading

Here, the red arrows indicate entry points for long trades. Scalpers would enter the market at these low points and would exit the trade as soon as the indicator reaches the top end of its range or if they observe a bearish crossover, which is when the green line dips below the yellow line.

Now, let’s examine the inverse situation.

Source: Delta Trading

In this case, the same basic principle applies as above. This time, however, since we have a downward trending market, instead of buying the lows, scalpers enter the market by selling the highs as soon as they spot a bearish crossover, as indicated by the red arrows.

Scalping trading tactic #2: the moving average

The moving average helps us determine what is the average market price of a given financial instrument over a specific period of time. Scalpers often use this information to buy when the instrument’s price goes above the MA border, and sell when it goes below it. In their day-to-day trading, scalpers tend to use three moving averages (two short-term and one long-term) in order to pinpoint the market trend. Here is how this works in practice.

Source: Delta Trading

On this price chart, we are using a:

– 5-period moving average (tracks movements in a range of 5 candles)

– 20-period moving average (tracks movements in a range of 20 candles)

– 200-period moving average (tracks movements in a range of 200 candles)

On the chart above, the longer-term (200-period) MA is rising. This means that in order to take any positions in the direction of the trend, the five-period MA must go above the 20-period MA. In this case, this divergence is marked by the red arrows.

Source: Delta Trading

If instead of rising, the longer-term MA is declining, then scalpers would look for short positions when:

– The 5-period MA is below the 20-period MA

– The market price is below the 5-period MA

When using moving averages, it’s important to remember that your focus should not fall on seizing every opportunity that comes your way but on making safe trades. Typically, it’s best to enter the market only after a thorough risk assessment and after placing strategic stops in order to limit any big losses.

Scalping trading tactic #3: the RSI indicator

The RSI (relative strength index) is one of the oldest indicators in existence. It is used to compare the “strength” of the highs and lows of an asset’s price within a specific time frame to predict any sudden spikes and thus minimise losses. Similar to the stochastic oscillator, its values also range between 0 and 100. Unlike the oscillator, however, values over 30 typically signal an oversold market, while values above 70 indicate an overbought market. Scalpers use the RSI to identify market entry points that follow the direction of the dominant trend.

Source: Delta Trading

In the chart above, we see that the trend is predominantly bullish, as indicated by the rising moving averages. This means that any dips in the trend, such as the one indicated by the red arrow, could become potential entry points for scalpers. The strategy here is simple: scalpers buy their way into the market when the RSI indicator drops to 30 and starts climbing back up.

Source: Delta Trading

Conversely, each time the RSI reaches a value of 70 and then slowly declines as in the second example, a selling opportunity will be created instead.

Scalping trading tactic #4: the parabolic SAR indicator

The SAR (stop and reverse) indicator was developed by the same person who created the RSI and is used to predict the price direction of an asset, as well as to alert traders when that direction is changing. It is displayed through a dotted pattern above and below the candles. Dots below the candles signal a bullish market and vice-versa, while any sudden pattern changes indicate that a new trend — either bullish or bearish — is about to start.

Source: Delta Trading

Looking at the chart above, it tells us two things: opportunities to go short (when the price is below the dots) and long (when the price is above the dots). Depending on the chosen market, scalpers can observe both extended and short-lived moves, as is the case here.

YOU MAY ALSO LIKE: 7 Technical Indicators Every Trader Should Learn

Thinking of scalping the market? Read this first

While a perfectly viable strategy, scalping is not for everyone as it requires great discipline and can often turn into a huge time sink that not many could afford. Here are some pointers you need to keep in mind if you ever decide to walk the path of the professional scalper:

– Ensure you have sufficient free time. Unlike long-term strategies that give you the freedom to step away from the platform every now and then, scalping will often have you glued to the screen for the whole duration of the session as entry points appear one second and disappear the next. This method is therefore not recommended to people with day jobs or other significant time commitments.

– Don’t chase after trades. Since scalping requires you to make multiple trades, the risks of making a costly error due to poor risk assessment or heightened stress levels as the day progresses increase exponentially. If you don’t have the discipline and patience to actively trade for hours on end, it’s best that you look into longer-term investment strategies instead where the stress and commitment levels are generally much lower.

– Make sure you have safety nets in place. The most common mistake of beginner scalpers is to disregard any safety measures, such as appropriate stop levels. While entering and exiting the markets in a flash may sound exciting at first, it could also spell disaster pretty quickly if you carelessly jump from one trade to the next without following a clear trading plan.

Conclusion

Scalping has rightfully won the hearts of traders for its many advantages, the biggest of which is the lower risk exposure compared to other trading styles. That being said, if you wish to turn pro scalper, then having some fundamental knowledge of how the markets work, how to perform technical analysis using RSI and other indicators, and taking a more disciplined approach towards trading, in general, will ensure that you will go in well equipped – both mentally and skill-wise – to deal with everything the markets decide to throw your way.

***

Looking to practice scalping on your own terms? Open a free demo account with virtual €10,000 and access over 1000 markets in a real market environment, without risking real funds.

OR

Disclaimer: This article is for information purposes only. The information herein provided does not constitute a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in this article, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page. Deltastock AD shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealised gains that may result.