Author: DeltaStock

Reading time: 4 minutes

Have you ever wondered why so many traders swear by the MetaTrader platform? Well, our team of expert market analysts finally have the answer!

Join us as we look at 6 reasons why Deltastock MetaTrader 5 has become the trading platform of choice for thousands of traders – and why it could be yours, too.

1. CFDs on over 800 financial instruments

Unlike its predecessor Deltastock MetaTrader 4, where you could primarily trade forex pairs, with Deltastock MetaTrader 5 you can trade CFDs on:

– Forex: close to 80 major and exotic forex pairs await you

– Shares: Apple, Airbnb, Netflix, Nike, Tesla, Boeing and more

– Indices: leading U.S., European and other indices

– Commodities: U.S. (WTI) and UK (Brent) oil

– ETFs: 50+ exchange-traded funds covering a variety of sectors

– Cryptocurrencies: popular cryptocurrencies, such as BTC, Ether and more

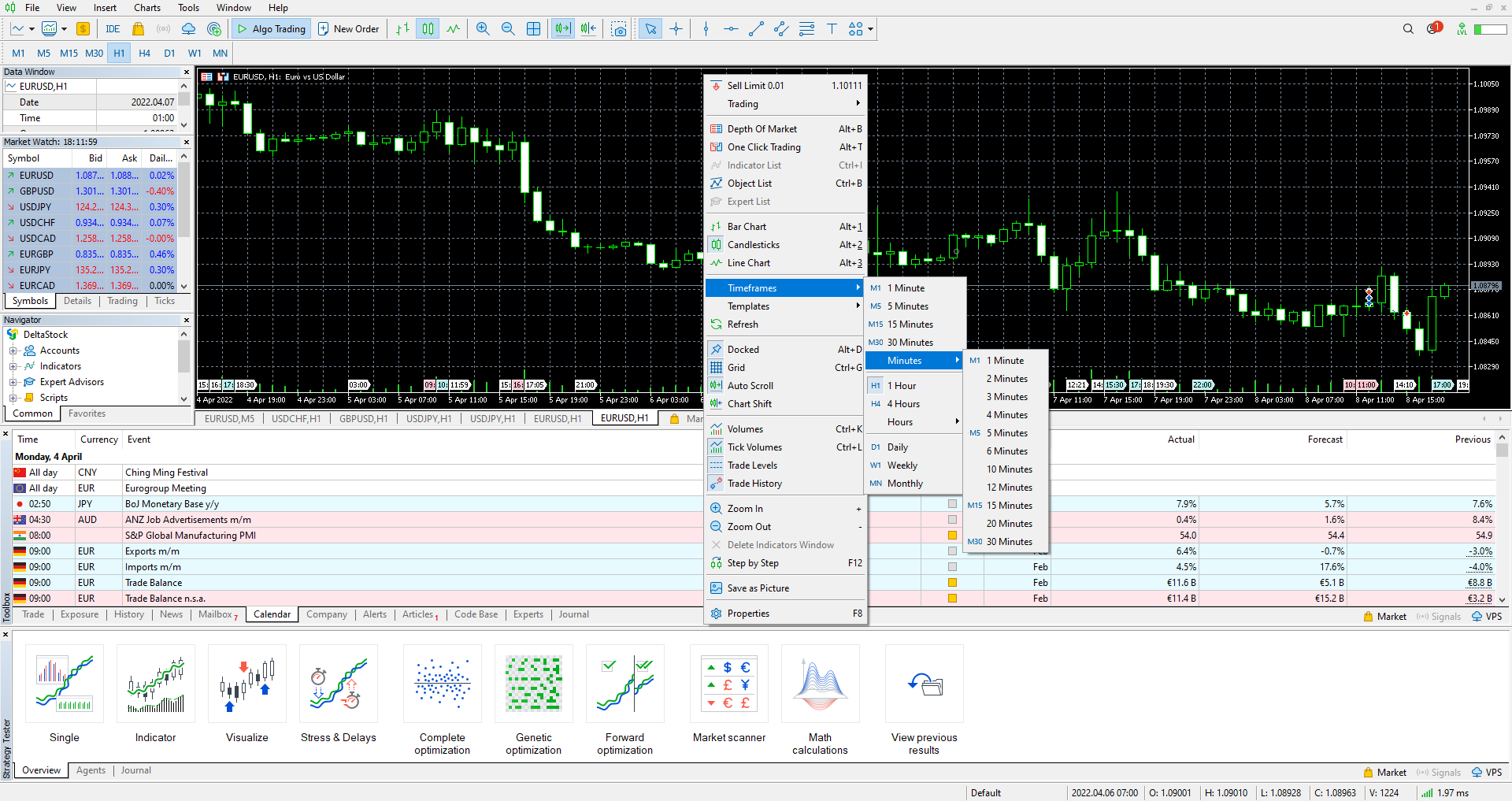

2. Many timeframes to choose from

One of the reasons why MetaTrader 5 has become a leading trading platform on a global scale has to do with its wide selection of timeframes (21 in total). For comparison, MetaTrader 4 – its predecessor – sported a selection of just 9 timeframes. You can access the timeframe menu by right-clicking a desired price chart → “Timeframes”.

Pictured: selecting a minute-based timeframe

3. Flexible risk control tools

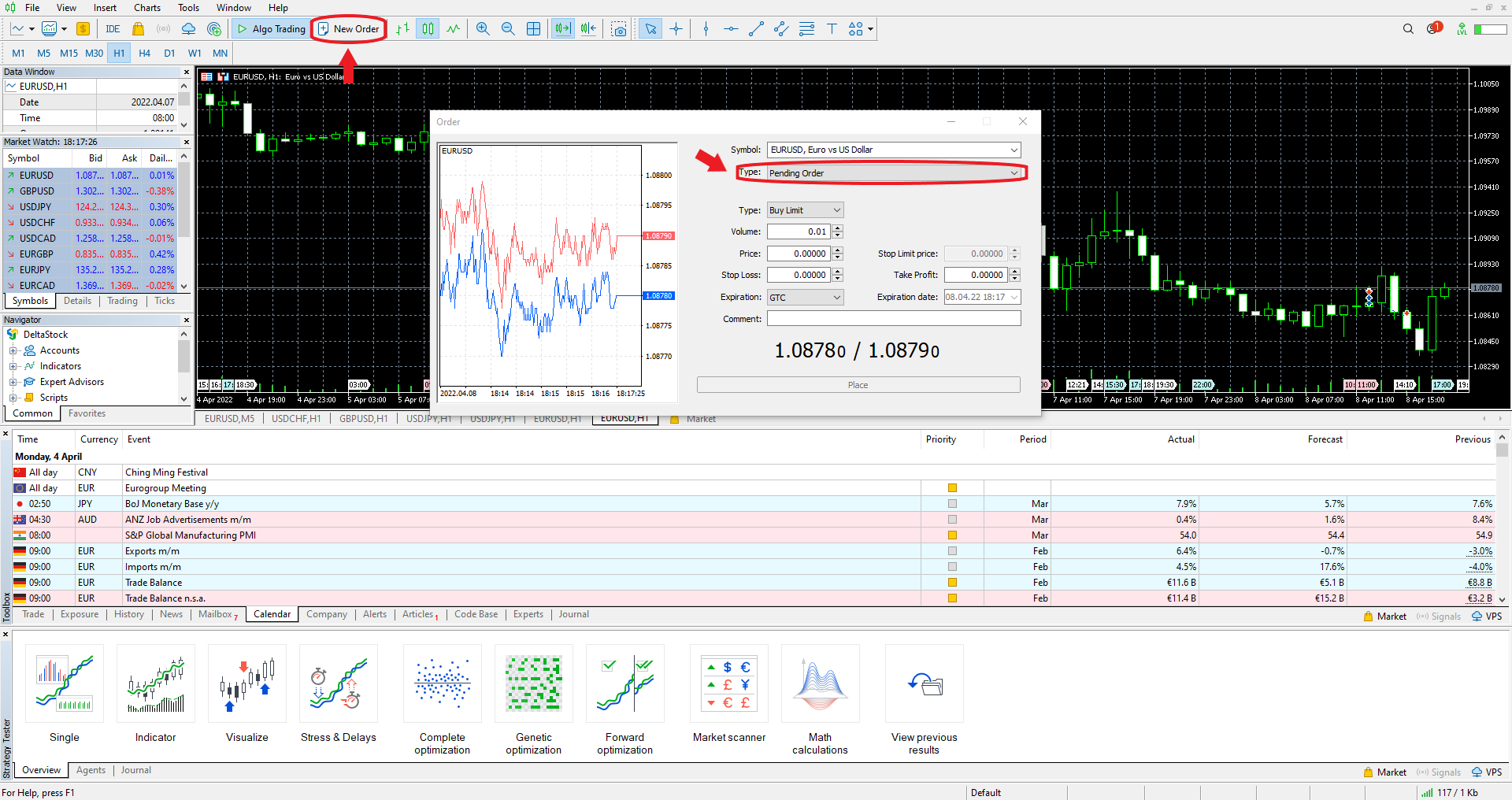

Depending on your strategy, with Deltastock MetaTrader 5 you can take advantage of a total of 6 pending order types. With the help of pending orders, you can instruct the trading platform to buy or sell a given asset when its price reaches a predetermined amount. These orders are:

– Stop-loss: automatic position closing when the market moves against you

– Limit buy/sell: automatic buying or selling of an asset when it reaches a price set by you

– Stop limit buy/sell: a combination of a stop and a limit order which places a limit order for buying or selling once the asset reaches a predetermined stop level

– Take profit (a type of limit order): automatic closing of the position when a price rises to a level set by you

You can learn more about some of these order types here.

To place a pending order, open a price chart of the instrument you wish to trade and either click on “New order” or press “F9”. After that, choose “Pending Order” from the “Type” dropdown menu and specify the type of order that you wish to use.

Pictured: choosing a pending order type

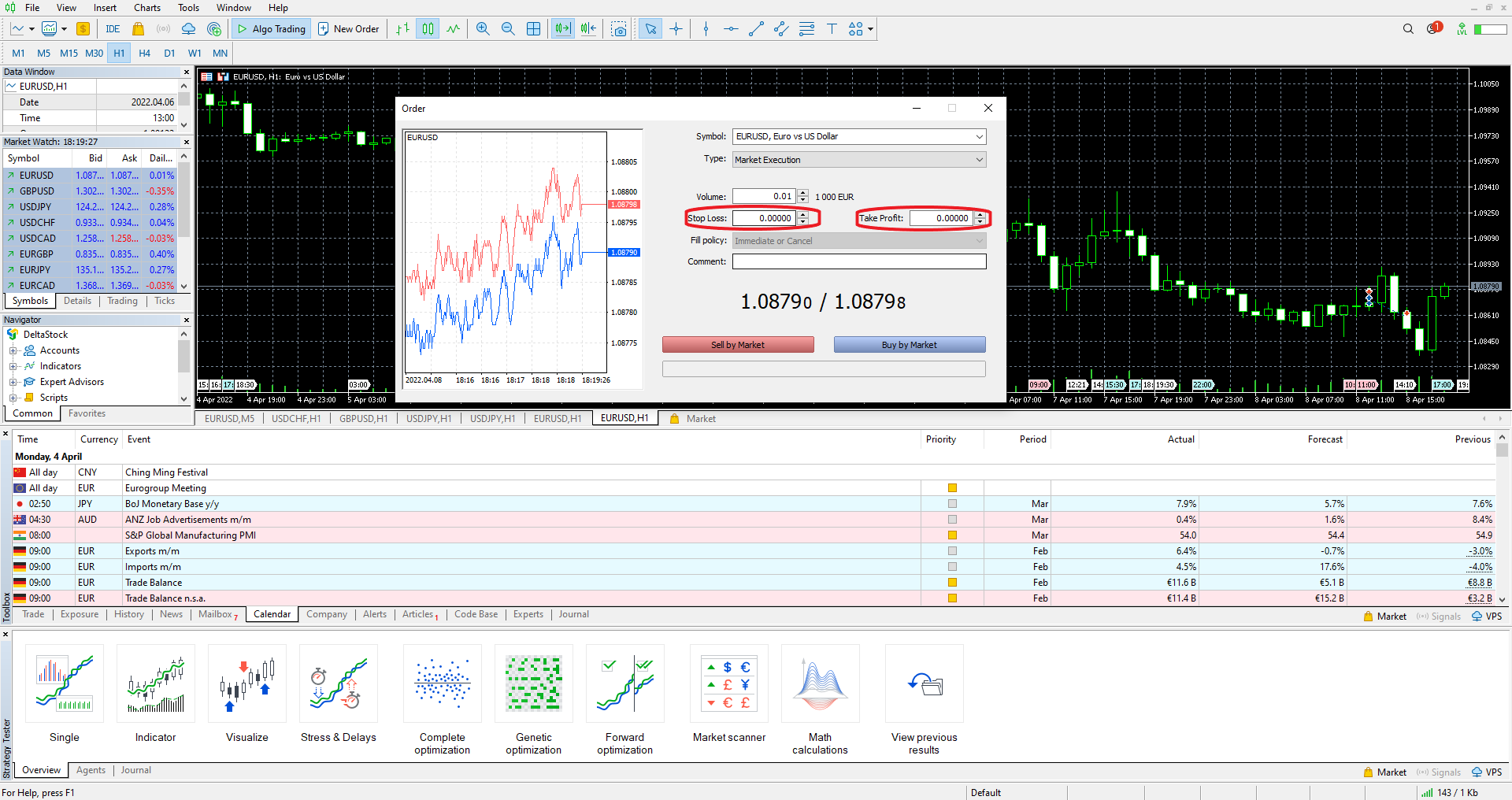

When placing a market order, you can also directly attach a limit and/or a stop order to your open position, which will come into effect as soon as the market order is executed. This will allow you to better manage the market risks from the moment you place your buy or sell order on a given financial instrument, and in doing so, improve your chances for success.

To attach a pending limit or stop order to your market order, simply type in the desired values in either the “Stop Loss” (stop) or “Take Profit” (limit) fields.

Pictured: attaching a stop and a limit to a position

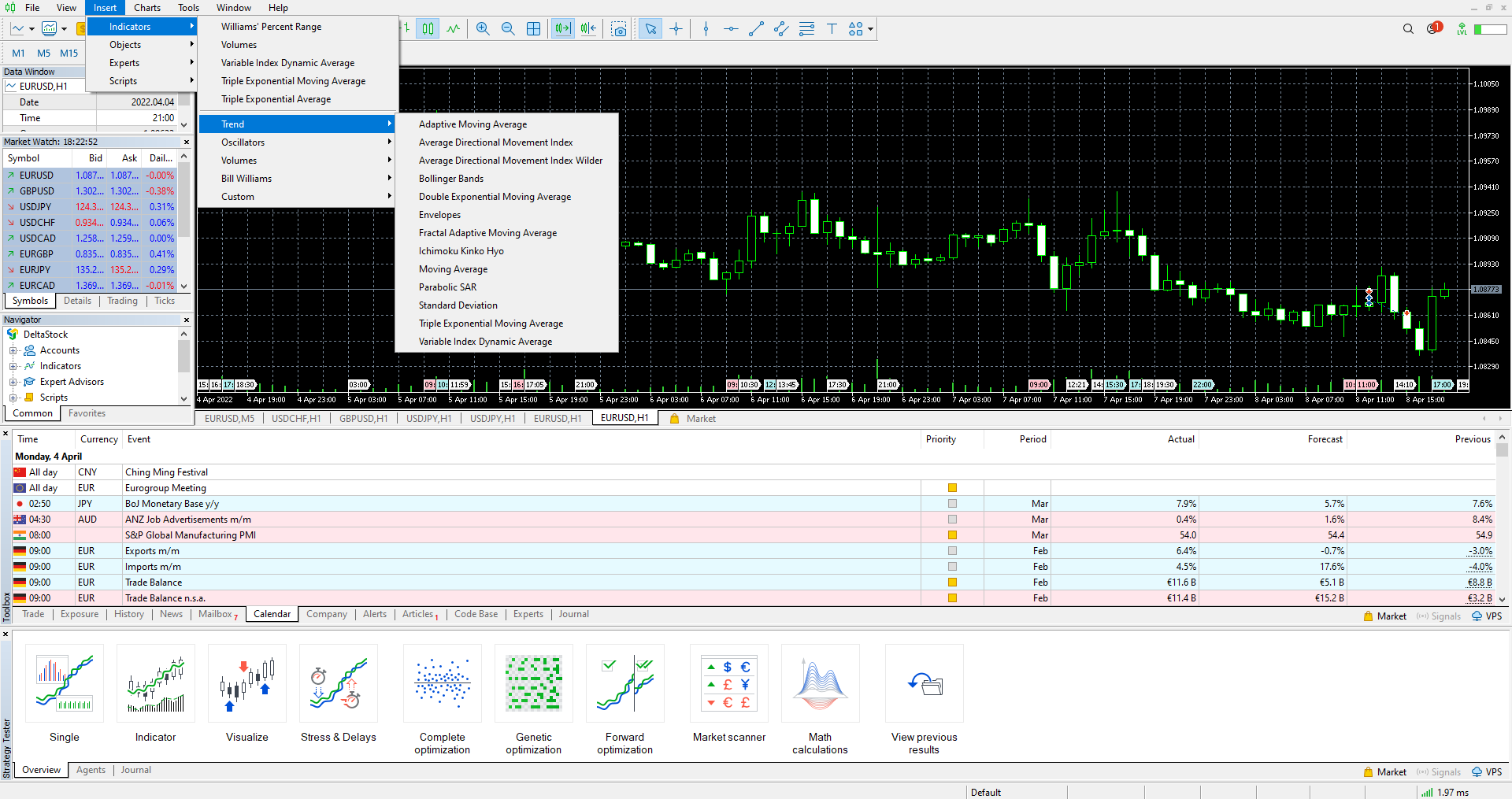

4. All leading indicators in one place

The platform comes with a staggering amount of built-in indicators (over 80) for performing detailed technical analysis, all of which could be easily customised. The indicators can be accessed through “Insert” → “Indicators” and are broken down into several different categories:

– Trend

– Oscillators

– Volumes

– Bill Williams

– Custom

Pictured: inserting technical indicators within a price chart

In addition, you can also either buy or freely download even more technical indicators through the built-in MetaTrader Market, allowing you to customise your trading workflow in virtually unlimited ways.

New to technical indicators? Here is a list of the most popular ones and how they work.

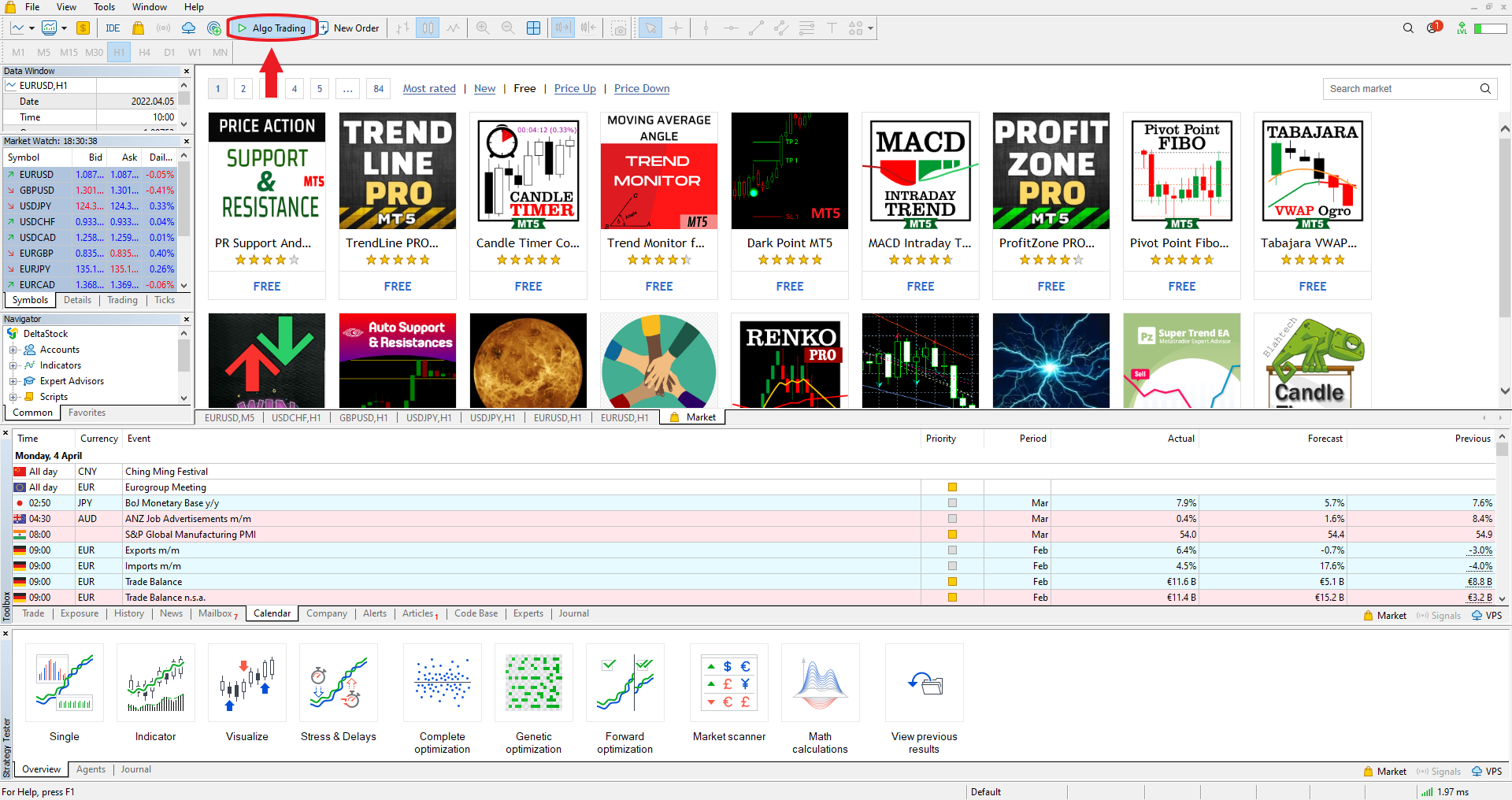

5. Automated trading through robots

The Deltastock MetaTrader 5 trading platform offers automated trading functionality through robots, also known as Expert Advisors, that analyse the market and execute trading orders in accordance with your strategy. They can be purchased through the built-in MetaTrader Market.*

*Please note that Deltastock AD does not offer trading robots and therefore cannot guarantee their reliability. Please also note that, In order to start trading with Expert Advisors, you first have to allow their use by enabling the “Algo Trading” functionality, as shown below.

Pictured: enabling the platform’s Algo Trading functionality

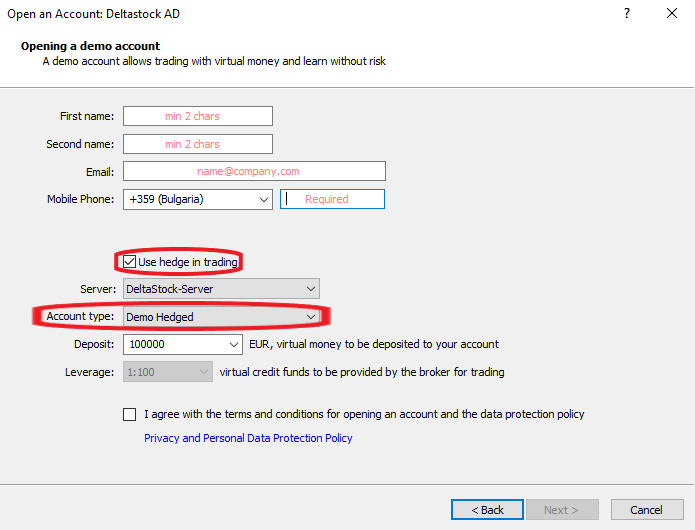

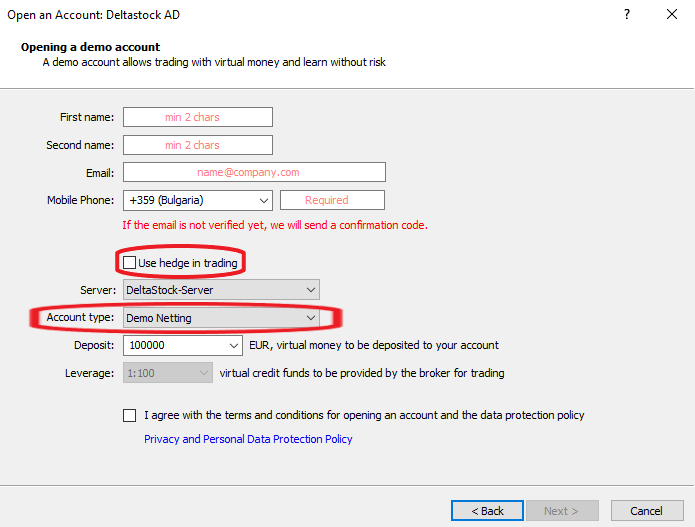

6. Two trading methods: hedging and netting

Deltastock MetaTrader 5 offers two modes to choose from, depending on your trading style and preferences. With the hedging method, you can have several open positions in one instrument, including opposite positions. Тhe netting mode, on the other hand, allows you to only have a single position in a given instrument. That being said, if you wish to test both methods, then you would need to create two separate demo accounts.

Demo account with hedging mode enabled:

Pictured: opening a demo account in hedging mode

Demo account with netting mode enabled:

Pictured: opening a demo account in netting mode

In conclusion

We hope that the information we’ve just shared with you will come in handy when preparing your trading strategy. We would also like to suggest that you try out the free tools on our website, found under the “Resources” tab, such as our daily technical analysis, currency converter, market stats and more.

Until next time and happy trading!

***

Ready to venture outside of your comfort zone? Take the next step – invest in CFDs on over 800 financial instruments from any part of the globe with a minimum account opening deposit of €100 or $100.

Disclaimer: This article is for information purposes only. The information herein provided does not constitute a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in this article, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page. Deltastock AD shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealised gains that may result.