We are on the cusp of a potentially transformative shift in the stock market, driven by the increasingly significant role of Artificial Intelligence (AI). A recent report from Goldman Sachs Research, penned by analyst Ryan Hammond, sheds light on these fascinating projections.

Consider this scenario: If AI can fuel an annual productivity increase of 1.5% over the next decade, the projected annual growth rate of S&P 500’s earnings per share (EPS) over the forthcoming 20 years could reach a robust 5.4%, a noticeable surge from the current estimate of 4.9%. This upward revision could consequently elevate the S&P 500’s value by approximately 9% from its present level. Importantly, this potential growth isn’t limited to firms with a direct involvement in AI development; it has potential implications for revenues and earnings across the broader economy.

However, we must balance this optimistic perspective with the recognition that accurately predicting when companies will start realising substantial profits from AI remains a complex task. Consequently, investors may be hesitant to fully factor these prospects into their valuations in the immediate term. Given different productivity scenarios, the S&P 500’s value could potentially appreciate between 5% and 14%. But several factors, including changes in government policy, tax increases, fluctuations in interest rates, or a slowdown in economic growth, could offset these potential gains.

We must also remember lessons from the dot-com boom: excessively high valuations tied to perceived growth potential can lead to a precipitous fall if growth rates don’t meet expectations.

For example, NVIDIA is reaping significant benefits due to the AI boom and the company’s stock has risen 200% YTD. NVIDIA’s price-to-sales ratio, a crucial valuation metric, has risen sharply to 40.7486 from 26.5 in 2023, indicating high investor confidence in the company’s growth potential. However, this surge in financial metrics also implies that the company’s stock could be overvalued. Therefore, it’s essential for investors to scrutinise NVIDIA’s soaring ratios considering its financial stability, future growth potential, and the inherent uncertainties of the high-growth tech sector.

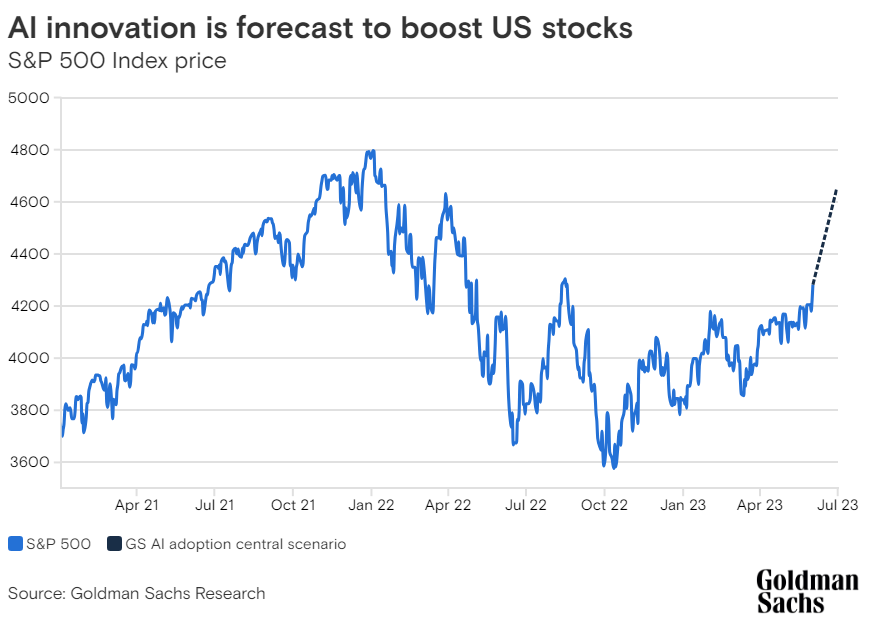

On a related note, Goldman Sachs Research recently revised its year-end forecast for the S&P 500 upwards, from 4,000 to 4,500. This suggests an anticipation of a broadening rally that extends beyond the dominant major cap stocks. The 2023 EPS forecast, however, remains unaltered at $224. With AI offering potential for further profit growth, the prospects for equities seem brighter, albeit with inherent risks from potential recessions and a stringent Federal Reserve policy.

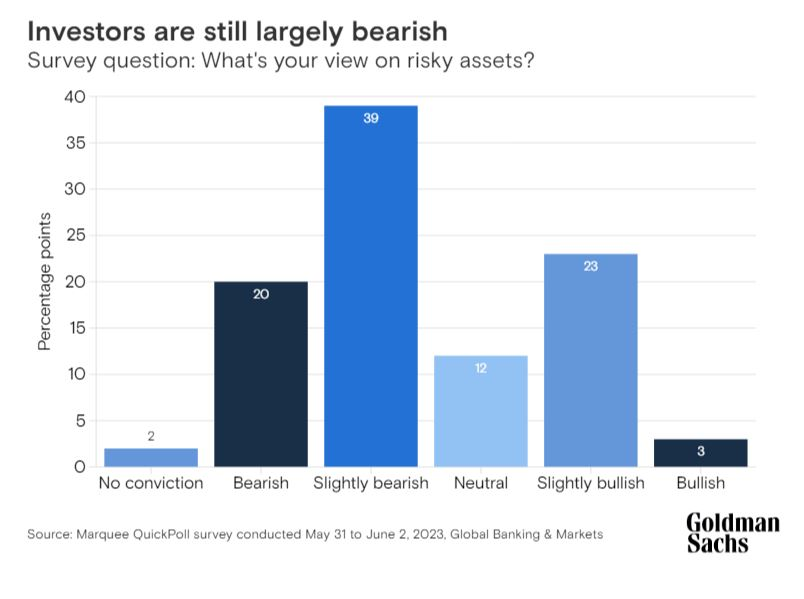

Interestingly, despite these potential positive trajectories, investor sentiment remains relatively bearish, according to a recent survey. Approximately half of the respondents are bracing for a U.S. recession within the year and demonstrating a preference for bonds over equities. The recent rally in the tech sector, notably in AI, has likely posed challenges for those not heavily invested in this area.

Finally, investor sentiment towards various investment options has undergone a noticeable shift. There is dwindling optimism towards the ‘China reopening trade’, a rising preference for short-term bonds for their price appreciation potential, and an increased positivity towards developed market equities. Indeed, investors are now three times more likely to enhance their investments in developed market equities rather than decrease their holdings.

In conclusion, AI seems poised to make a significant impact on Wall Street, presenting an exciting, yet complex, transformation.

Ivailo Chaushev,

Chief Market Analyst at Deltastock

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

73% of retail investor accounts lose money when trading CFDs with this provider.