The ongoing depreciation of the yen has become a focal point for market watchers and economists. The yen is trading through its tightest monthly trading range in over a year and a half, with the potential intervention by the Bank of Japan (BOJ) looming over the market, acting as a deterrent for yen bears.

As of this month, the variance between the dollar-yen’s highest and lowest levels is recorded at a mere 2.7%, showcasing restrained fluctuations even when the Japanese currency reached a ten-month low earlier. This situation stands in contrast to July when an unexpected adjustment by the BOJ to its yield-curve control led to a range nearly double at above 5%.

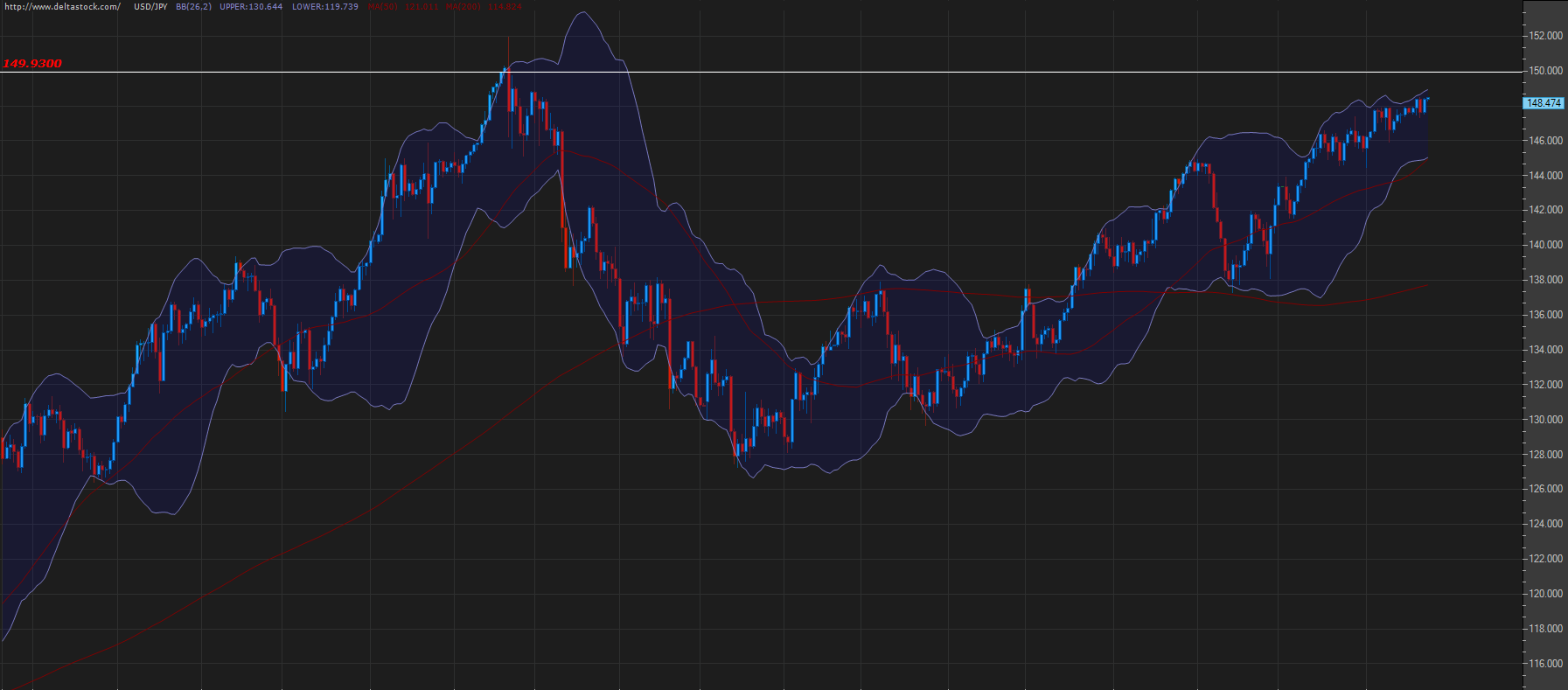

Source: Delta Trading

The yen’s performance remains relatively stable, priced at 148.36 at the time of this writing, inching closer to the crucial level of 150 against the dollar. The continual warnings from government officials have tried to calm down the market, despite the broad difference in interest rates between Japan and the U.S., which is the primary driver for the yen’s depreciation.

The market is actively assessing the threshold of yen weakness that will trigger the BOJ to intervene, especially as we inch closer to last year’s peak levels. This has increased speculations that the BOJ will intervene around the 150 levels.

Additionally, expectations of an impending deviation from the BOJ’s ultra-accommodative monetary policy have risen after comments by a central bank official hinted at sufficient data accumulation by year-end to review the current negative rates. Subsequently, many have anticipated policy tightening to occur in the first half of 2024.

Despite core inflation surpassing the BOJ’s 2% target for the seventeenth consecutive month, central bank officials have maintained a cautious stance on retracting its expansive policy. The bank stresses the absence of sustainable inflation and substantial wage growth which would bolster household consumption and economic growth, before considering policy alterations.

However, when the bank decides to tighten rates, it’s not devoid of inherent risks. The uncertainties around the sustainability of wages and inflation levels are significant. The goal to achieve 2% inflation with corresponding wage gains, as per the central bank official, Ueda, remains elusive.

The current BOJ policy, keeping yen’s implied yields below zero, positions it as a favoured source among investors seeking to acquire higher-yielding currencies. The recent data reveals a maintained net short position on the yen by hedge funds and asset managers.

Prime Minister Fumio Kishida affirmed that Japan is prepared to counteract excessive currency movements. The Ministry of Finance is also purportedly maintaining active communication with its U.S. counterparts, highlighting a mutual consensus on avoiding excessive moves.

Given the aligned stance of the BOJ and the Ministry of Finance on preventing a further rise in dollar-yen, the possibility of new interventions, designed to give BOJ the necessary breathing space before considering policy shifts, seems to be an evolving reality.

But this is only one side of the story as we also need to take a look at the dollar.

The prevalent stance among most officials of the Federal Reserve (Fed) seems to be inclined towards anticipating an additional rise in rates before the year concludes. Key figures like Susan Collins and Mary Daly, who are the presidents of the Federal Reserve Banks of Boston and San Francisco, respectively, have highlighted the prevailing notion.

Both Collins and Daly emphasised the cooling down of inflation but underscored the necessity for additional rate hikes. They illustrated that, even with a relatively subdued inflation, there exists a requirement to adjust rates in response to the evolving economic environment.

Neel Kashkari, the Minneapolis Federal Reserve President, shared insights, expressing surprise over the resilience of consumer spending. He reflected that he would have expected a noticeable constriction in consumer spending, following 500 basis points (bps) or 525 bps of interest rate increases. However, contrary to expectations, consumer spending has not experienced a decline.

Market participants are now shifting their focus towards upcoming economic events and data releases. Japan’s Tokyo Consumer Price Index (CPI) for September, along with Industrial Production and Retail Sales, are to be released on Friday. These data points will be scrutinised to gauge the economy of the nation and increase FX volatility

A significant event to watch this week will be the release of the U.S. Core Personal Consumption Expenditure (PCE) Price Index. It stands as the Fed’s preferred measure of consumer inflation. The conclusions derived from this reading will be extremely important for determining the inflationary trends value of currencies.

In conclusion, the yen seems to be in quite a bit of trouble against the dollar, given the difference in interest rates and the BoJ might not want to tighten its monetary policy, but might be forced to. All eyes remain on the 150 level against the dollar and whether or not BoJ officials will flinch as an intervention remains more and more likely.

Ivailo Chaushev

Chief Market Analyst at Deltastock

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

60% of retail investor accounts lose money when trading CFDs with this provider.