Over the past few decades, the United States has experienced several periods of monetary policy tightening, characterised by increases in the Federal Funds Rate (FFR). These rate hikes have significant implications on the financial environment, particularly on firms’ ability to access credit. This article examines the correlation between monetary policy tightening and lending standards, discussing the potential risks and benefits associated with further rate hikes on the U.S. economy.

Why are Bank Lending Standards important?

Lending standards serve as a valuable indicator of the financial landscape in the U.S., reflecting banks’ willingness to extend credit. When banks tighten lending standards, they restrict access to credit for businesses and consumers, leading to dampened economic activity. On the other hand, looser lending standards signal an easier credit environment, promoting growth and investment.

The U.S. has witnessed four significant periods of monetary policy tightening since the early 1990s:

- 1993-1995

- 1999-2001

- 2004-2007

- 2016-2019

- 2022 – ?

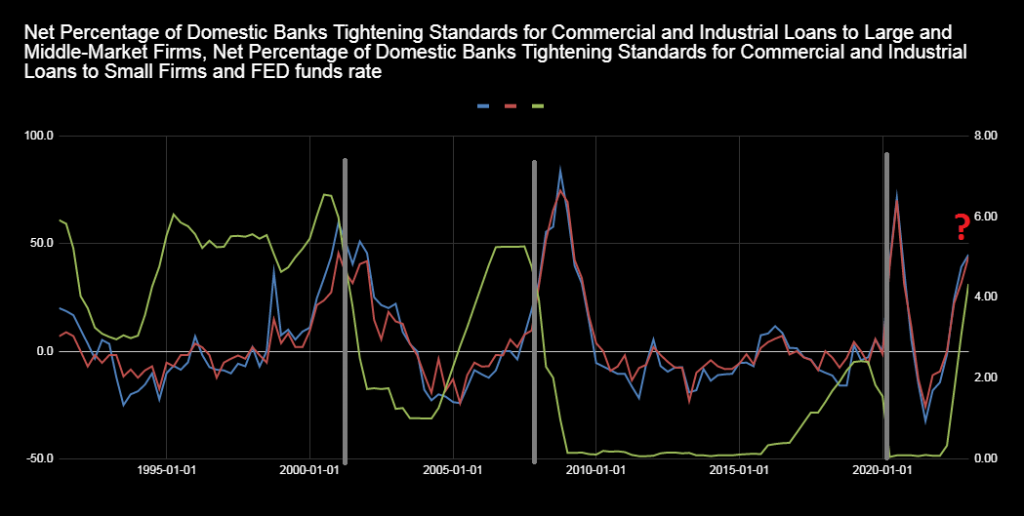

During each of these episodes, a noticeable increase in banks tightening lending standards occurred a few quarters after the rate increases. This pattern suggests that financial conditions become more stringent due to monetary policy tightening, with the effects taking hold after a short lag as can be seen from the chart below. In the present cycle, financial conditions have been tightening closely in tandem with the Fed funds rate. This suggests that they will likely continue to get more stringent, given the lag effect, as the Fed funds rate increases further.

In the chart below the green line shows the Fed funds rate, the blue and red lines show the net percentage of domestic banks tightening standards for commercial and industrial loans to small and large firms. The grey lines indicate recessions.

Source: Federal Reserve Bank of St. Louis

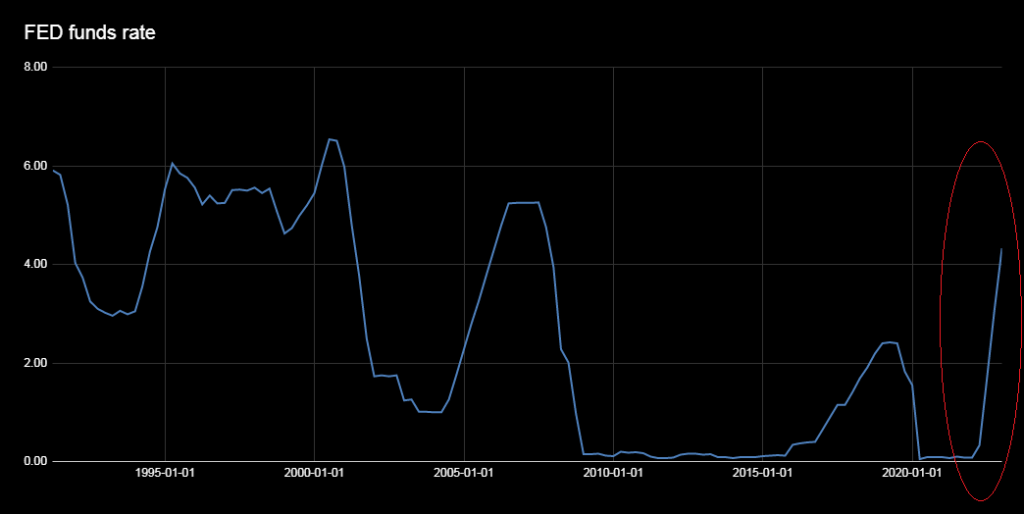

Monetary policy tightening is an effective tool to address inflationary pressures, maintain financial stability, and ensure sustainable economic growth. By raising interest rates, the Federal Reserve aims to reduce the amount of money circulating in the economy, thereby managing inflation expectations and preventing the economy from overheating. In doing so, the central bank can also promote responsible lending practices and mitigate risks associated with excessive borrowing and asset bubbles. However, 10 years of ultra loose monetary policy have led to the need of a very, very aggressive tightening cycle which will most likely push the economy into a recession. It is important to emphasise that the current rate hike is particularly aggressive, as can be seen in the steep incline of the blue line shown below.

Source: Federal Reserve Bank of St. Louis

But what are the risks from the tightening itself?

While monetary policy tightening can play an essential role in managing inflation and maintaining financial stability, but it can also have a negative impact on the economy:

- Higher interest rates can lead to increased borrowing costs for banks and financial institutions, reducing their profitability and ability to lend. This may result in a higher rate of bank failures (as we have recently seen), reduced competition, and higher lending rates for borrowers.

- As banks tighten lending standards in response to higher interest rates, businesses and consumers may find it more challenging to obtain credit, leading to reduced investment and consumer spending, and potentially a recession.

- Higher borrowing costs can lead to reduced spending on credit-dependent purchases such as automobiles and homes, impacting industries reliant on consumer demand and leading to job losses and economic stagnation.

- Firms may become more hesitant to invest in growth and expansion due to increased borrowing costs, slowing job creation, innovation, and overall productivity.

- The cost of servicing existing debt for both businesses and consumers increases with higher interest rates, potentially leading to higher default rates and bankruptcies.

- Higher interest rates can disproportionately affect lower-income households and small businesses, exacerbating income inequality and hampering economic mobility.

- Changes in U.S. monetary policy can significantly impact international financial markets, as higher interest rates in the U.S. can lead to capital outflows from emerging markets, potentially destabilising these economies and causing financial contagion.

Now comes the big question – what will the Fed do at its next meeting?

As the next rate hike period approaches, most major U.S. banks, along with their global counterparts, are expecting the Federal Reserve to raise interest rates by another 25 basis points next month. This follows the Fed’s decision to press ahead with a rate hike in March, despite the U.S. banking crisis and tightened lending conditions raising concerns of a potential recession.

Money markets are currently pricing in an 85% chance of a 25 bps hike from the Fed in May. If this occurs, the Fed Funds rate will reach 5%, resulting in a rate of 5% to 5.25%. Traders anticipate a pause after this and expect rate cuts to begin in the second half of the year in a major disconnect with the market’s expectations of a cut.

Forecasts from major U.S. banks and their global counterparts for the May Fed Terminal Rate and U.S. recession predictions include:

🏦 Bank of America: 25 bps hike, 5% – 5.25%; sees a meaningful risk of contraction in Q2

💰UBS: 25 bps hike, 5% – 5.25%

🏦 J.P. Morgan: 25 bps hike, 5% – 5.25%; foresees a U.S. recession in Q4 2023

💰 Morgan Stanley: 25 bps hike, 5% – 5.25%

🏦 Deutsche Bank: 25 bps hike, 5.10%; expects a moderate recession

💰 Goldman Sachs: 25 bps hike, 5% – 5.25%

🏦 Citi: 25 bps hike, 5.5% – 5.75% terminal

💰 Societe Generale: 25 bps hike, 5.5% – 5.75% terminal

🏦 Wells Fargo: 25 bps hike; believes a recession is likely in the second half of the year

🌐 Nomura: No hike

Our expectations are for a 25 bps hike, but we also think that the Fed might be making a mistake by raising interest rates in May as the banking crisis has subsided. However, there are still underlying issues brewing and the real estate market is starting to show cracks, risking over tightening the main rate. Additionally, the labour market has not yet felt the full impact of the tightening.

Ivailo Chaushev

Chief Market Analyst at Deltastock

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

73% of retail investor accounts lose money when trading CFDs with this provider.