Source: Dreamstime

At Deltastock we believe that a balanced and structured analysis of some of the most traded instruments would be beneficial for our clients. To a large extent, the arguments in the analysis of a currency instrument remain valid when trading other crosses, due to the interdependence of the markets.

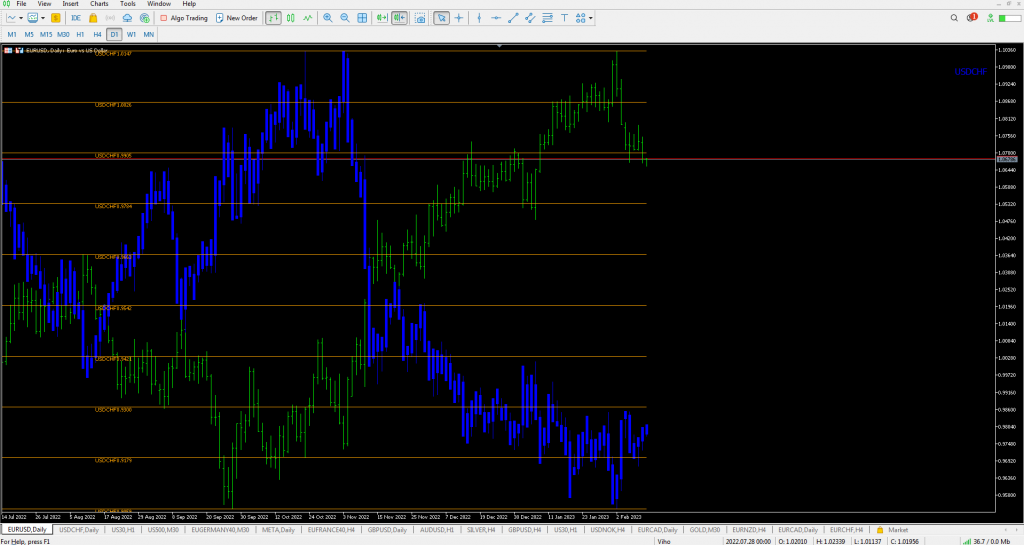

For example, the analysis for EUR/USD can be directly applied when analysing the USD/CHF cross, due to the very high negative correlation. That is, if the euro-dollar rises, the dollar-franc most likely falls, and vice versa. But for both currency pairs, the arguments for the USD would be valid.

The below chart shows EUR/USD (the green curve) and USD/CHF (the blue curve).

Source: Deltastock MT5

In this article, we examine the EUR/USD in the framework of a SWOT (Strengths, Weaknesses, Opportunities and Threats) analysis.

Strengths

- Low volatility in the FX market so far has generally been favourable for the euro and emerging market currencies.

- Another below-consensus decline could, however, prompt dollar weakness as investors are more inclined to view the labour market figures as a blip and that the narrative of a slowing economy and an end to Fed rate hikes remains intact.

- The Euro’s recovery has been driven to a great degree by the relief that the Eurozone has passed the peak of its energy crisis.

Weaknesses

- The dollar has risen alongside U.S. bond yields as investors have begun to price in a higher interest rate profile in the U.S.

- Europe’s single currency tumbled last Friday as U.S. bond yields rallied and Fed Funds rate futures adjusted to imply a move to 5% and beyond, after a January surge in non-farm payrolls report appeared to undermine the prospect of an impending pause in the Fed interest rate cycle.

- The EUR/USD has declined strongly in the past two weeks, after the price formed a bearish Engulfing pattern on a weekly basis and bounced down from the 100-period SMA (Simple Moving Average) as shown in the chart below.

Source: Deltastock MT5

Opportunities

- The recent months’ narrative is that the U.S. economy is sliding into recession, this would bring down inflation and allow the Federal Reserve to end its interest rate hiking cycle.

- In fact, ahead of the data release bets had appeared that the Fed would start cutting the rate by the middle of the year.

- The dollar would rise further, should inflation comes in stronger than markets are expecting as this would reinforce the message from the jobs report, namely that the economy remains strong enough to churn out uncomfortably high inflation rates.

Threats

- The dollar rose against all its major peers after it was reported the U.S. created in excess of 500K jobs in January, a figure nearly three times higher than the amount markets were expecting.

- This reflects tightness in the labour market as well as scope for further supply shocks. The USD could find some traction into the middle of the year as the market adjusts to a ‘higher for longer’ Fed view.

- Over the weekend, the member of the executive board of the European Central Bank (ECB) Ignazio Visco warned that the increase of real interest rates in Europe must be avoided, which would be necessary for the servicing of corporate and state debt. This week, speeches are expected from members of the ECB‘s Executive Board (Lagarde, Holzmann, Luis De Guindos), as well as members of the Federal Reserve (Williams, Bullard, Mester).

In conclusion, we hope that this SWOT analysis of the EUR/USD pair has provided valuable insights into the potential risks and rewards associated with this currency pair. As a trader, it’s important to recognize the strengths and weaknesses of the EUR/USD pair. By doing so, you can better position yourself to take advantage of potential opportunities while being aware of the potential risks. As always, it’s important to exercise caution and implement effective risk management strategies to make informed decisions when trading the EUR/USD pair.

Deltastock’s Capital Markets department

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

76% of retail investor accounts lose money when trading CFDs with this provider.