Source: DeltaStock

It’s no secret that market orders—those that allow the instant purchase or selling of any asset at its current market price, are widely popular among both novice and experienced traders.

But what if we don’t want to pay the current price of our chosen financial instrument? The solution to this problem is using the so-called conditional orders—flexible instruments that make semi-automated trading possible.

What is a conditional order?

Unlike the market order, the conditional order does not necessarily have to be filled out instantly. Instead, it allows you to set a preferred price at which you want to buy or sell and asset ahead of time. Once you’ve made your choice, the trading platform will closely monitor the markets and do the rest of the heavy lifting for you while you’re hanging out with your friends at the, say, local pub.

Types of conditional orders

Standard conditional orders

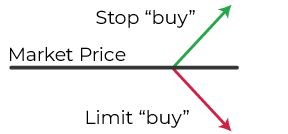

Broadly speaking, conditional orders fall into two main categories: “Stop” and “Limit” orders.

– The limit order instructs the platform to automatically buy or sell an asset when it reaches your requested (or better) price. Limit orders can be placed above and below the market price.

– The stop order instructs the platform to fill out an order when the asset’s price has reached your requested (or worse) price. Just like limit orders, stop orders can be placed above and below the market price.

The inherent unpredictability of the markets has necessitated the creation of several variations of the orders we’ve just described. These are:

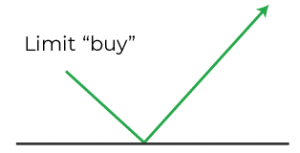

1. Limit buy.

Used when you expect the price of an asset to increase after decreasing to a certain amount. It’s a postponed buy order placed below the asset’s market price.

Used when you expect the price of an asset to increase after decreasing to a certain amount. It’s a postponed buy order placed below the asset’s market price.

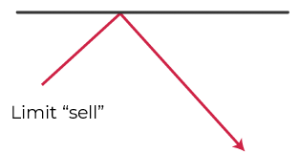

2. Limit sell.

Used when you expect the price of an asset to decrease after increasing to a certain amount. It’s a postponed sell order placed above the asset’s market price.

Used when you expect the price of an asset to decrease after increasing to a certain amount. It’s a postponed sell order placed above the asset’s market price.

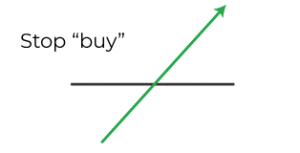

3. Stop buy.

Used when you expect the price of an asset to continue to increase after rising to a certain amount. It’s a postponed buy order placed above the asset’s market price.

Used when you expect the price of an asset to continue to increase after rising to a certain amount. It’s a postponed buy order placed above the asset’s market price.

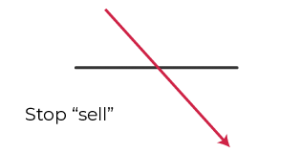

4. Stop sell.

Used when you expect the price of an asset to continue to decrease after falling to a certain amount. It’s a postponed sell order placed below the asset’s market price.

Used when you expect the price of an asset to continue to decrease after falling to a certain amount. It’s a postponed sell order placed below the asset’s market price.

Advanced conditional orders

The choices here are many, which is why we’ll only touch on this subject briefly. One example of advanced conditional orders are OCO (One-Cancels-the-Other) orders that are offered by most online trading platforms. In practice, an OCO order consists of two conditional orders. In an OCO, whichever of the orders gets filled out first will automatically cancel the remaining order.

For instance, we can place limit buy and stop buy orders at the same time. In this scenario, should the market rise, the stop will be filled out and will cancel your limit order. And should the market fall, the limit will activate and cancel the stop. Another example of an OCO order is an attached limit sell and stop sell order to the same open position.

For instance, we can place limit buy and stop buy orders at the same time. In this scenario, should the market rise, the stop will be filled out and will cancel your limit order. And should the market fall, the limit will activate and cancel the stop. Another example of an OCO order is an attached limit sell and stop sell order to the same open position.

Conditional orders will operate independently from your open position and will remain active even when that position is closed.

Three compelling reasons to use conditional orders

If you’re still having doubts about the effectiveness of conditional orders in your day-to-day trading routine, we hope that these 3 reasons will incline you to include them in your arsenal.

1. They give you more confidence

One of the main benefits of using conditional orders is that they allow you to plan your trades ahead of time. Ultimately, this will give you a nice confidence boost since you will already have a detailed trading plan in place before starting your trading session.

Another plus to using them is that you won’t have to spend long and exhausting hours in front of your computer screen in an attempt to trace every market movement.

2. They help you minimise losses

There’s likely not a single trader who hasn’t held a losing position until the last possible moment, hoping that by some stroke of luck their decision would pay off in the future. But the truth is that not all trades can be won. Conditional orders will allow you to exit an unfavourable positions with less losses and will give you an opportunity to ride the next winning trend.

3. You improve your self-control

Conditional orders will give you some peace of mind and will teach you how to objectively look at both wins and losses, as well as how to keep your emotions in check when trading.

The hidden risks of conditional trading

Source: Pexels.com | Photographer: Nejc Košir

The main drawback of conditional orders is their inability to catch up with the markets in times of high volatility. A military conflict between two countries, for instance, would send strong ripples across the oil market in a matter of hours or even minutes. In this case, there’s a risk that your stop order may not close your position at the requested price on time, which in turn could lead to bigger-than-expected losses.

That said, there are some good news as well—most of these situations can be successfully circumvented if you follow a few rules. These are:

1. Never allow your emotions to do the decision-making for you. Your conditional orders should always be placed or altered based on rational arguments and solid technical and/or fundamental analysis of the markets.

2. Avoid opening positions without an emergency escape plan. This rule applies equally to both your potential profits and losses.

3. Don’t underestimate market volatility. An asset you perceive as safe today might turn into a financial black hole tomorrow, so always be ready to react accordingly to the changing market conditions.

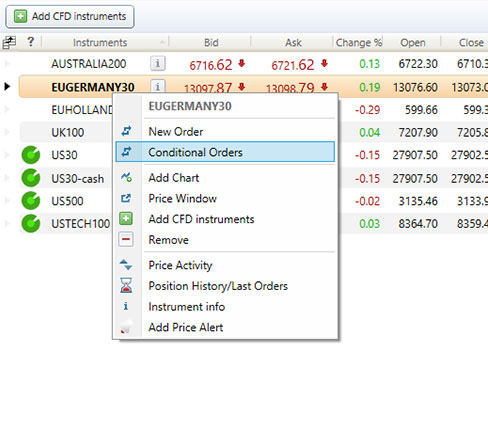

How to place a conditional order in Delta Trading

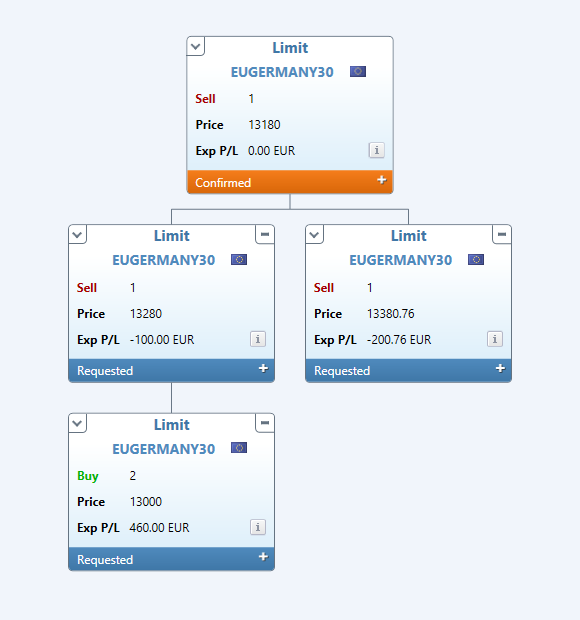

With the desktop version of Delta Trading* you can attach conditional orders to an already placed order. This essentially allows you to create a “tree” of up to 100 interconnected conditional orders in order to meet the needs of any trading strategy.

Pictured: How to add a conditional order in Delta Trading | Source: DeltaStock

An extra bonus of using this functionality is the ability to execute each tree “branch” (conditional order sequence) once or as many times as you need. When you open up your tree, you will also be able to see the expected P/L (profit/loss) ratio that each branch could generate.

Pictured: A conditional order tree in Delta Trading | Source: DeltaStock

*Please note that while this functionality is also available in our web version of our platform, it will be presented differently from what we’ve shown here. Please also keep in mind that, for each conditional order, there will be a commission equal to 0.007% of the price of your trade.

Final words

As you’ve probably already concluded on your own, trading orders come in different shapes and sizes to accommodate the individual needs of each trader. Looking for the “one size fits all” order is a pointless exercise since such order simply doesn’t exist. Instead, you should carefully weigh the strengths and weaknesses of each order type. As you gain more experience on the global markets, you’ll eventually be able to use them to their fullest potential in your day-to-day trading.

***

Looking to test your knowledge of conditional orders without risking any real money? Open a €10,000 demo account today and test even the boldest of strategies through a powerful trading platform with over 80 technical indicators.