Welcome to this week’s analysis, where we will be focusing on the top 5 AI stocks and the top 5 reasons we have shortlisted them, including their current price targets.

As the world continues to move towards automation and digitalisation, artificial intelligence has become increasingly important in various industries. With that in mind, we have scoured the market and have selected the top 5 AI stocks that we believe have the potential for significant growth in the future.

Microsoft’s AI investments: Microsoft is one of the largest investors in AI, having spent billions of dollars on research and development, as well as on acquisitions of AI startups, most notably Chat GPT. The company has made significant investments in natural language processing (NLP), computer vision and machine learning.

Azure Cognitive Services: Microsoft’s AI platform, Azure Cognitive Services, offers a suite of pre-built APIs that developers can use to easily integrate AI capabilities into their applications. These APIs include speech recognition, image recognition, natural language processing and more.

Azure Machine Learning: Microsoft’s cloud-based machine learning platform, Azure Machine Learning, is designed to help data scientists and developers build, train and deploy machine learning models at scale. The platform offers tools for data preparation, model training, deployment and monitoring.

Partnerships and collaborations: Microsoft has formed partnerships and collaborations with other companies and organisations to advance the development of AI. For example, the company has partnered with OpenAI to develop advanced AI models and it has collaborated with the United Nations to use AI for humanitarian purposes.

AI applications: Microsoft has developed AI applications in a variety of industries, including healthcare, finance and manufacturing. For example, the company has developed an AI-powered virtual assistant for healthcare professionals and it has created an AI-powered financial risk management solution.

According to information from Refinitiv Eikon, the average price target of analysts for the stock is $292, which represents an upside potential of approximately 16%. This suggests that the market is optimistic about the future performance of the stock and sees room for growth.

Google’s AI investments: Google has been a major player in the field of AI, having spent billions of dollars on research and development. The company has made significant investments in machine learning, natural language processing, computer vision and robotics.

TensorFlow: Google’s open-source machine learning platform, TensorFlow, is one of the most popular machine learning platforms in the world. The platform offers tools for building and training machine learning models and it has a large and active community of developers.

Google Cloud AI: Google’s cloud-based AI platform, Google Cloud AI, offers a suite of pre-built APIs and tools for developers to easily integrate AI capabilities into their applications. These APIs include speech recognition, natural language processing, computer vision and more.

AI applications: Google has developed AI applications in a variety of industries, including healthcare, finance and transportation. For example, the company has developed an AI-powered medical diagnosis tool and it has created an AI-powered system to help reduce traffic congestion.

Research and collaborations: Google has a strong focus on research and collaborations in the field of AI. The company has formed partnerships with other companies and organisations to advance the development of AI and it has also created several research initiatives, such as Google Brain and DeepMind.

According to Refinitiv Eikon, the average price target for Google, as predicted by analysts, is $129.40, which represents a potential upside of approximately 40% from its current trading price.

NVIDIA’s AI investments: With the AI arms race picking up speed, NVIDA stands out as a leader among the chipmakers. Its accelerated computing solutions are used in analytics, medicine, the automotive industry, deep learning and data science, to name a few.

NVIDIA GPU: NVIDIA’s graphics processing unit (GPU) is one of the most widely used platforms for accelerating machine learning and other AI workloads. The company’s GPUs are widely used by researchers and data scientists to accelerate model training and inferencing.

NVIDIA AI platforms: NVIDIA offers a suite of AI platforms, including NVIDIA DGX, which is a purpose-built AI supercomputer that offers high-performance computing for training and inference. The company’s platforms are designed to enable developers and data scientists to build, train and deploy AI models at scale.

AI applications: NVIDIA has developed AI applications in a variety of industries, including healthcare, finance and transportation. For example, the company has developed an AI-powered medical imaging platform and it has created an AI computing platform enabling automobile makers to develop self-driving vehicles.

Research and collaborations: NVIDIA has a strong focus on research and collaborations in the field of AI. The company has formed partnerships with other companies and organisations to advance the development of AI and it has also created several research initiatives, such as the NVIDIA AI Research Lab.

According to data from Refinitiv Eikon, analysts are optimistic about the future performance of NVDA stock. The average price target for the stock is $257, which represents a potential upside of 9%. This suggests that analysts are expecting NVDA to continue its upward trajectory, despite recent market volatility.

Amazon’s AI investments: Amazon has been investing heavily in AI, with a particular focus on machine learning and natural language processing. The company has made significant investments in developing AI technologies and has acquired several AI companies to further its efforts.

Alexa: Amazon’s voice assistant, Alexa, is one of the most widely used voice assistants in the world. The platform offers a range of services, including voice recognition, natural language processing and speech synthesis.

Amazon Web Services (AWS): AWS offers a suite of AI services, including machine learning, processing and analysis of data and images, chatbot applications, business metrics, etc.

AI applications: Amazon Recognition makes it easy to add image analysis for applications, Amazon Polly is a service that turns texts into lifelike speech, Amazon Lex is a service for building conversational interfaces into any application using voice and text, Amazon EMR is a flexible, customizable, and manage big data processing platform.

Research and collaborations: Amazon has a strong focus on research and collaborations in the field of AI. The company has formed partnerships with other companies and organisations to advance the development of AI, and it has also created several research initiatives, such as the Amazon AI Research Lab. Amazon is well-positioned to continue to make significant strides in the AI space.

According to data from Refinitiv Eikon, analysts are optimistic about Amazon’s future prospects, with an average price target of $137.00 This represents an upside of around 48% from its current trading price.

ASML’s AI investments: ASML is a leading semiconductor equipment supplier and it has made significant investments in AI to improve its products and services. The company has focused on developing AI algorithms for process optimisation, quality control and predictive maintenance.

Lithography equipment: ASML’s lithography equipment is widely used in the semiconductor industry, and the company has been developing AI algorithms to improve the performance and efficiency of its equipment. The company’s lithography equipment is critical in the production of advanced chips which are used in a variety of industries, including consumer electronics, healthcare and automotive.

Partnerships and collaborations: ASML has formed partnerships with other companies and research organisations to advance the development of AI in the semiconductor industry. The company has also collaborated with customers to develop custom AI solutions for their specific needs.

AI applications: ASML has developed AI applications for a variety of purposes, including process optimisation, quality control and predictive maintenance. For example, the company has developed an AI-powered system that can predict equipment failures and schedule maintenance to avoid downtime.

Research and development: ASML has a strong focus on research and development, and the company has created several research initiatives to advance the development of AI in the semiconductor industry. The company has also invested in talent development to ensure that it has the necessary expertise to develop and implement AI solutions.

According to data from Refinitiv Eikon, the average price target for ASML stock is $805, indicating a potential upside of 29%. Analysts are optimistic about the company’s future prospects as it continues to lead in the semiconductor industry. Despite facing supply chain challenges and other headwinds, ASML’s strong financial position and strategic partnerships have positioned it well for future growth.

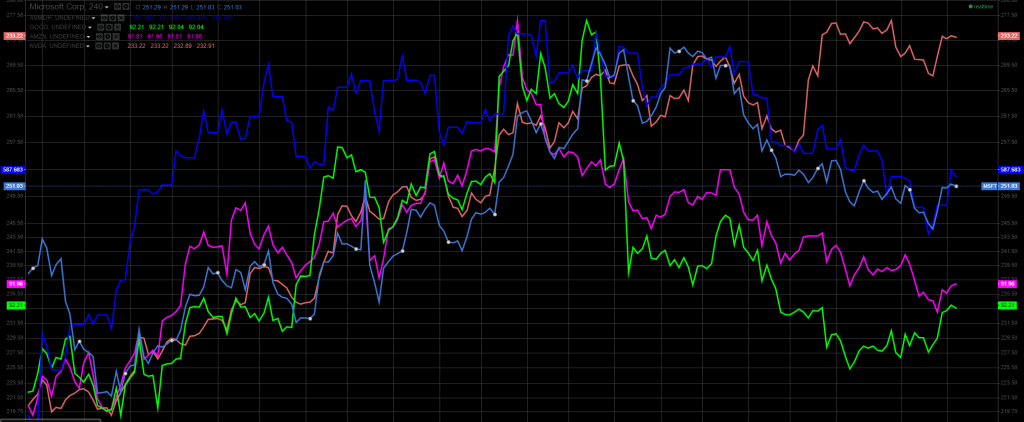

Below you can see the YTD performance of the analysed stocks.

Source: Delta Trading Web

Light Blue – MSFT

Dark Blue – ASML

Green – GOOG

Pink – AMZN

Orange – NVDA

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

76% of retail investor accounts lose money when trading CFDs with this provider.