Source: Pexels.com | Photographer: Jens Mahnke

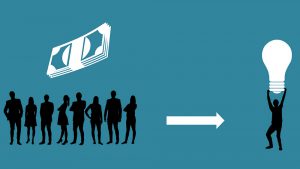

In the past few years, the terms “investment” and “investor” were supplemented with a host of new words like “pre-seed stages”, “seed stages”, “venture capital rounds”, “crowdfunding”, “peer-to-peer lenders”. All these terms are related to startups and the elaborate multi-layered system of startup financing that evolved from the straightforward bank loans of yore.

Today, we distinguish four main tiers of startup financing, depending on how far the company is in its development at the time of funding, how big the investment is, and on other factors.

***

In the world of startups, sometimes these investors are friends of the entrepreneurs and are just doing a friendly favour.

Others, like the majority of smart investors, do a thorough research and analysis in order to maximise profits or would lend money in exchange for shares in the company.

A third group would provide entrepreneurs with advice and guidance in addition to money.

Without these types of early investors, many of today’s successful startups would not be where they are. But who exactly are they?

Pre-seed investors

Source: Pixabay.com

These are the individuals who have faith in a project and decide to invest in it right from the start. Depending on their goals, relationship with the founders, and experience, pre-seed investors can be conditionally split into two groups: angels and triple “F”s.

FFF investors

FFF stands for “fools, friends and family”. A FFF investor would be someone who has lent or simply given money to a friend, sibling, or another relative.

More often than not, the FFF investors make a mistake and lose their investments as they are driven by emotions and the wish to do a favour, rather than by a cold calculating mind. This is where the “fools” in the name comes from.

Angel investors

Also known as business angels, this type of investors usually includes affluent entrepreneurs who support interesting projects with lots of potential, providing capital in exchange for convertible debt or ownership equity.

Since many startups have trouble finding funding for their innovative and untested products or services, they seek the help of angel investors who can be found on popular platforms like AngelList.

In most cases, the angels invest their own capital and do not seek a high return. Rather, they expect a return on their investment plus something on top. Yet, unlike the FFF investors who are not very picky about what they invest their money in, angel investors do their homework and back promising projects that have a chance of succeeding.

Seed investors

Source: Pixabay.com

After the FFF and the angel investors follow the seed investors. They usually come after the startup has already finished a product or service, but lacks the funds to market their product. Unlike angel investments which tend to be smaller, seed investments can amount to millions of dollars.

There are many types of seed investors, but generally they can be divided into two main categories: equity crowdfunders and syndicate investors.

Equity crowdfunders

Unlike popular crowdfunding platforms like Kickstarter, Indiegogo, and Seedrs where backers receive material rewards as products or services, equity crowdfunders become shareholders and have some influence over the company they backed.

Also, equity investors usually receive progressive returns and their income increases if the company is successful.

Syndicate investors

In syndicate investing, two or more angel investors get together and invest in a company. Here is how it works:

1. An investor with good reputation and track record of successful investments finds a promising startup and puts a portion of the sought-after amount.

2. Then they recommend the company to other angel investors who trust their judgment.

3. The other investor/s pay the remaining part of the sum to complete the funding round.

Venture capitalists

Venture capitalists (VCs) are professional investors who have their own venture capital companies. Those companies raise money from pension funds, wealthy people, and other partners.

Source: Pixabay.com

The accumulated funds are then invested in startups with a viable business model which, however, need funding. Similarly to business angels, VCs seek out companies with good growth and profit potential. Unlike angels, however, VCs avoid taking risks and consider startups only if their ROI is high.

Since VCs are managing corporate as opposed to personal funds, they have larger funds at their disposal and their investments can exceed the $1 million range. Additionally, startups can benefit from series of VC rounds in exchange for stocks and a seat on the board of directors.

Strategic investors

Strategic investors are similar to VCs in that they also seek companies with a working product or service who look for funding. Unlike the VCs, however, who only give the money and reap the benefits, strategic investors offer provide:

– Business advice: many strategic investors have been heads of companies themselves and can provide practical advice and support to the company;

– Networking: if the strategic investor cannot help, they most likely know someone who could.

Source: Pixabay.com

Unlike VCs who have a dislike for risk, strategic investors are inclined to take some risk and back experimental or riskier projects, but they can offer much less money than VCs.

These investments usually have a clear strategy behind them—for example, helping a company acquire a needed technology or hiring an expert in the field.

***

Willing to give the global markets a shot? Benefit from 1000+ financial instruments and test the waters in a safe market environment with a €10 000 demo account.