Source: Dreamstime | Author: DeltaStock

Reading time: 13 minutes

Just as the world was about to exit a two-year-long pandemic that shook the global economy to its core and forced millions of people to explore remote work options, it was dragged headfirst into a wave of violence and a humanitarian tragedy not witnessed since the Second World War.

Thus, when Russian President Vladimir Putin ordered his troops to invade Ukraine in the early morning of February 24th, 2022, he caught many investors completely off-guard.

The resulting conflict has put more pressure on an already reeling post-COVID economy, led to thousands of casualties on both sides, and forced over 3.25 million Ukrainians to flee their country. But while this event is no doubt equal parts tragic and horrifying, does this mean that investors should liquidate all of their assets and run to their hideout with all of their profits?

Not at all! In fact, the best thing to do right now is to keep calm and adapt your strategy accordingly – after all, history is on your side. But before we get to the good part, let’s do a quick recap of how the ongoing war has affected the global markets so far.

Vladimir Putin vs. the World

“This is the start of a new Cold War. The conflict could take a variety of forms and isn’t likely to be resolved soon. Over time, it will also become more difficult to get information about what’s happening in Ukraine, which will add to the uncertainty.”

David Bridges, a geopolitical risk analyst for Fidelity Investments

At the time of writing this article, the Russia-Ukraine conflict is stretching into its fourth week and has resulted in tremendous destruction of civilian property and perhaps the most comprehensive sanctions package against a country the world has ever seen in its modern history. Some of the heavier sanctions, which are aimed at crippling Russia’s economy and its oligarchs, included a nationwide SWIFT ban, the freezing of over $600 billion in foreign cash reserves, and the recent ban on Russian oil imports by the U.S. and the UK.

The geopolitical turmoil has also forced many big-name multinational companies to temporarily or permanently terminate all their business operations in the region. Among them are:

– Financial sector: JPMorgan and Goldman Sachs

– Commodities sector: Apple and Nike

– Fast food sector: Coca-Cola, McDonald’s and Starbucks

– Energy sector: Shell, BP, Exxon Mobil and Equinor

– Aviation sector: Deutsche Lufthansa and Boeing

– Mining sector: Rio Tinto Group

In the first few days following the start of the war, the markets were rattled, but have since started to recover (more on that a bit later). Seeing that Russia is also a major exporter of both oil and natural gas, however, energy prices are already highly inflated, especially for Europeans who get a significant portion of their gas from Russian pipelines and who are now frantically looking into green alternatives. Food prices are also expected to rise as both Russia and Ukraine account for a considerable portion of the world’s agricultural supplies. For perspective, the exported wheat, corn, sunflower seed and other foodstuffs from both regions amounts to more than a tenth of all calories traded globally.

Weekly chart of the USD vs the Ruble for 05.2019 – 03.2022 | Source: Delta Trading

On the domestic front, the Russians are fighting another war – to salvage whatever is left of their economy. Due to the SWIFT ban, their national currency – the ruble – has plunged to record lows (at the time of writing it is worth less than one U.S. cent), which prompted the Russian central bank to boost its interest rate to an unprecedented 20%. In addition, the Russian stock market was temporarily halted, while the skyrocketing inflation has led to a steep increase in the prices of everything from bananas and multivitamins to tech and cars, with analysts predicting this situation to only get worse as the war drags on and Russia finds itself on the brink of default.

The War Puzzle Effect

“Intuitively, one would expect the uncertainty of the geopolitical environment to spill over into the stock market. However, that has not been the case, except during the Gulf War when volatility was roughly in line with the historical average.”

Mark Armbruster, president of Armbruster Capital Management

Wars rarely happen spontaneously, and the Ukraine-Russia conflict is no different as tensions between both countries were already exacerbated after the abrupt annexation of Crimea in 2014. The outbreak of the conflict saw the leading S&P index (US500) drop 5% and the price of Brent crude oil rally well above $100 per barrel, while gold jumped 3.9% to above $1900 a troy ounce.

The good news is that, although initially damaging to the global economy, in the long term the markets eventually grow accustomed to the geopolitical tensions and often perform even better than they did before the start of the war! In fact, shortly after this conflict began, European equities notched their biggest rally since March 2020, U.S. shares jumped the most since June 2020, while crude oil sank more than 10% to $110 a barrel. But why is that the case?

As it turns out, this is a well-documented phenomenon that researchers at the Swiss Finance Institute have dubbed “the war puzzle” after looking at U.S. military conflicts data following WWII. Upon closer inspection, they discovered that in all cases where a pre-war phase had threatened to escalate into a full-blown war, markets had initially taken a hit only to rise stronger once the gears of war actually started spinning. However, if the war caught the markets by surprise, the outbreak did the opposite effect and instead decreased stock prices.

In the current situation, a possible reason for the market rebound we are seeing now, in addition to the fact that the whole world suspected Russia’s true intentions months in advance, is that investors have realised that their bleakest forecasts for a full-blown nuclear WWIII will likely not come true, which prompted them to downgrade the conflict from a global to a regional one.

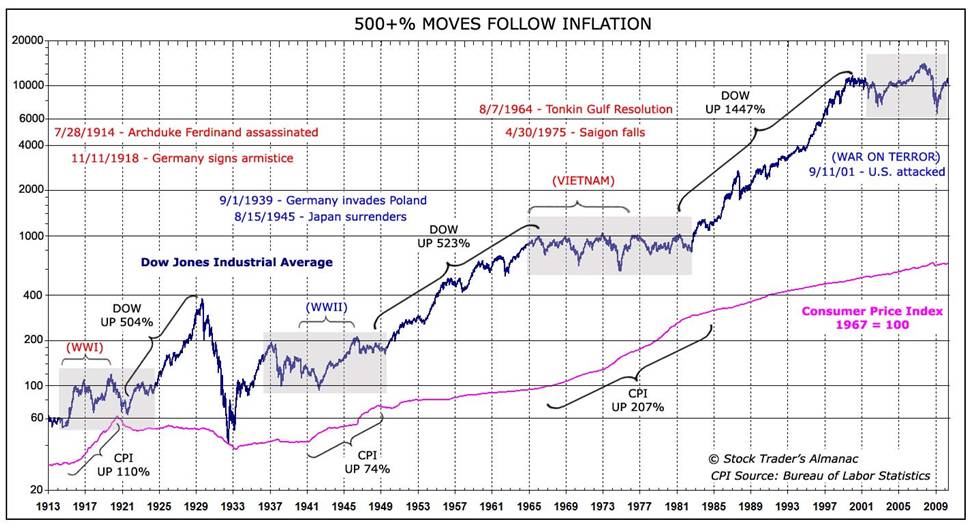

We know this all sounds somewhat counterintuitive, so let’s take a look at the graph below to make out what’s really going on.

Source: U.S. Bureau of Labor Statistics

As you can see, the graph tracks the historic market performance of the benchmark U.S. index Dow Jones (US30) throughout three major world events: World War I, World War II and the Vietnam War. Here are the highlights:

– At the end of WWI, the index gained a total of 43% (8.7% on an annual basis)

– At the end of WWII, the index gained a total of 50% (7% on an annual basis)

– At the end of the Vietnam War, the index gained a total of 43% (5% on an annual basis)

To sum up, the total gains that the US30 had realised during these highly volatile times were an average of 45% or about 7% on an annual basis. And while investors should never base their strategies solely on past performance, all of this goes to show that investing in times of war does hold the promise of being just as profitable, if not more so, than investments made in peaceful times, as long as you know where to look. Speaking of which…

…What safe havens should investors consider in these dire times?

Defence stocks

Weekly chart of BAE Systems stock for 05.2019 – 03.2022 | Source: Delta Trading

Let’s start with the obvious ones of the bunch – shares of companies in the defence and aerospace industry. As unfortunate as it is, the companies who produce guns and other offensive or defensive equipment typically tend to earn more money during geopolitical conflicts. Some of the shares investors could consider adding to their portfolio include:

– BAE Systems (a global defence, aerospace, and security company)

– Airbus (a European helicopter and aircraft supplier)

– Raytheon (maker of aircraft engines, helicopters and aerospace systems)

– Lockheed Martin (offers combat vehicles and related technologies)

– General Dynamics (an aerospace and defence company)

Out of all these, the first two look like particularly good picks at the moment since both companies have recently posted strong profits and cash flows. In addition to traditional defence stocks, cybersecurity companies are increasingly gaining traction as well due to the rampant cyberattacks that the world has endured in the last decade. Some starting points here could be:

– Avast (a Czech multinational cybersecurity company that offers antivirus software for computers and mobile devices)

– CrowdStrike Holdings (a U.S. company for cloud security that offers breach protection, threat intelligence and investigation of cyber attacks)

– Palo Alto Networks (provider of security platform solutions to enterprises, service providers, and government entities worldwide)

– Splunk (a U.S. multinational company offering software for monitoring, searching and analysis of big data)

Gold and copper

Weekly chart of investment gold for 05.2019 – 03.2022 | Source: Delta Trading

We’ve arrived at gold – the “holy grail” of safe havens since it’s widely used by investors as a hedge against inflation due to it typically holding its value compared to the world currencies. The start of the war has only added more fuel to the inflationary fire and so the shiny yellow metal has once more become a sought-after asset, with its price catapulting over 4% and is currently being on track of reaching $2000 per troy ounce.

Of course, in addition to owning investment gold directly or trading it as a CFD, investors could also consider purchasing CFDs on the shares of leading mining companies like Barrick Gold Corp and Rio Tinto Group or even an ETF tracking gold, although it is worth mentioning that some mining companies are currently struggling with the rising costs of inflation, so it’s best to choose them based on their most recent financial performance metrics.

Weekly chart of copper futures for 05.2019 – 03.2022 | Source: Delta Trading

Gold, however, is not the only metal that has benefitted from the unfolding humanitarian crisis. Since Russia is rich in natural resources and has a decent market share for copper, this has made the resource quite more valuable than it was just a month ago, as you can see from the price chart above.

Commodities

Weekly chart of natural gas futures for 05.2019 – 03.2022 | Source: Delta Trading

It’s no secret that Europe relies quite a bit on Russia when it comes to natural gas (over 30% of all gas imports, to be precise), with its own gas reserves rapidly dwindling at this point. The current crisis has already spiked the price of this fossil fuel to soaring heights. However, the real danger lies in Russia deciding to stop the gas flow altogether, which could potentially make the next winter season in Europe unbearable, unless it manages to somehow find new gas suppliers in the meantime.

An alternative would be for it to sign long-term liquefied natural gas contracts with Qatar, East Africa and the U.S., but it would still have to compete with the equally gas-hungry Asian market, so prices might be higher than Russia’s current offer. As unfortunate as this situation is, this does mean that the rising prices of natural gas currently makes it an attractive proposition to investors looking to strengthen their portfolio against the eroding effects of global inflation.

Weekly chart of Brent oil futures for 05.2019 – 03.2022 | Source: Delta Trading

Crude oil tells a similar story – at one point, the price hit a seven-year high of $115 a barrel, and although its rally has somewhat subsided since the first days of the invasion, the fact that big oil players with even bigger stakes in the Russian market, such as BP and Exxon, have severed their ties with the region, hints at possible price spikes in the near future due to supply shortages.

Technology and telecom stocks

Weekly chart of Microsoft stock for 05.2019 – 03.2022 | Source: Delta Trading

Typically, wartime scenarios call for investments in safer consumer staple stocks, such as those of a supermarket chain or a food producer. However, as these companies are currently falling victim to ridiculously high inflation rates, the situation this time is totally different. Instead, some professionals now see high-quality telecom and technology stocks as the better way to go. Microsoft shares, for example, currently look like a good solid option, with BT Group following suit.

The key to success here, however, is to seek out stocks of great companies built on solid fundamentals, which are currently underperforming due to unforeseen circumstances like the Russia-Ukraine situation and not because of something they did. Typically, this is also the time when the price of such stocks slips to more reasonable prices as companies adapt to the new market environment, so in the weeks and months ahead it is worth keeping a close eye on the tech sector as a whole.

Cryptocurrencies

Weekly chart of Bitcoin vs the USD for 05.2019 – 03.2022 | Source: Delta Trading

Since the war began, over 600,000 crypto donations totalling over $80 million (most made in bitcoin or ether) have been made to support the Ukraine government and its army, with the bitcoin market spiking 20% in the first days of the conflict, at one point even topping $45,000.

Similar to the oil situation, the rally has since subsided, but this event alone was enough to reignite the debate about its role in the global financial system and whether it could dethrone gold as the go-to safe-haven asset, particularly during times of war as its price, unlike that of fiat currencies, isn’t as vulnerable to collapsing the way the ruble did.

For investors with long-term goals in mind, the current decline can be a good opportunity to stock up on cryptocurrencies while their prices are low as, once the market bounces back, they potentially stand to generate significantly higher returns than investors who bought during more peaceful times. Of course, it’s never recommended to invest a large amount of money into the crypto market at once and it should never be more than you can afford to lose!

Conclusion: it’s not all as bad as it seems!

“Over the last few years, markets have been conditioned not to overreact to political and geopolitical shocks for two reasons: first, the belief that there would be no significant subsequent intensification of the initial shock; and second, that central banks stood ready and able to repress financial volatility.”

Mohamed Aly El-Erian, chief economic adviser at Allianz

While it can be tempting to go on a sell-off spree and take whatever profits you can during a major conflict, this could end up being a double-edged sword as the markets eventually bounce back. While no one can say for sure exactly when this will happen, if we look at how previous military conflicts played out, we will see that the global economy has always found a way to balance itself out in the long run, leaving those who panicked and sold their assets in the dust.

In addition, geopolitical uncertainties tend to lower the price of good quality stocks, which gives even more incentive for long-term investors to “hold it out” and play to their strengths. So, regardless of which safe haven strategy you choose – whether it’s going after gold, crypto, stocks, or a combination of all three – you should never allow yourself to panic as this could cloud your sound judgement and lead to undesirable outcomes.

And while the world has changed a lot in recent years and historical patterns may likely not repeat word for word, by diligently examining core market data, such as earnings, valuation, inflation, interest rates, and overall economic growth, you stand a higher chance of weathering this unfortunate war and emerging even stronger (both financially and mentally) than before.

Disclaimer: This article was published for information purposes only. It does not represent a buy or sell recommendation for any of the financial instruments herein mentioned. The information is obtained from generally accessible data sources and media.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in this article, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page. Deltastock AD shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealised gains that may result.

***

Feeling brave enough to invest during wartime? Trade all of the assets mentioned in this article and test your strategies in a safe market environment. Open your free practice account with virtual €10,000 with our proprietary platform Delta Trading or the popular MetaTrader 5.

OR