The global experts are unanimous that the coronavirus has caused an unprecedented crisis, comparable in scale and gravity to the Great Depression from the 1930s. And despite being obvious that the end of the pandemic is far and the crisis is only beginning, investors and analysts already make forecasts and draw plans for recovery.

Martin Tarpanov – a professional dealer with extensive experience and head of the Fixed Income Securities Trading department in Deltastock – has already presented his pessimistic and optimistic scenario for the global economy recovery and recently the investment bank J.P.Morgan laid out its forecasts for the recovery of the US economy.

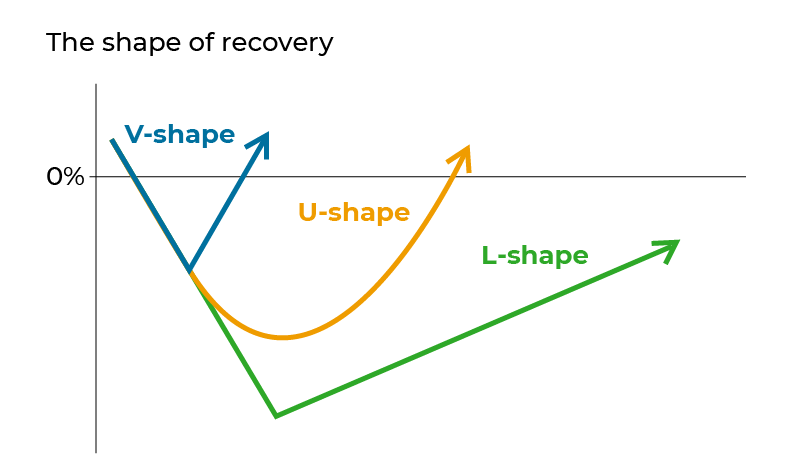

Jeff Greenberg and Joe Seydl – senior economists at J.P.Morgan – describe three possible scenarios for exiting the crisis – V-, U- and L-shaped, which illustrate the curve of recovery.

Scenarios and probabilities

V-shape

In the case of a V-shape recovery, it is expected that the recovery will be as fast and sharp, as the decline. In this scenario the rules for social distancing and the restrictions on the business are lifted fast and in H2 2020 the growth manages to compensate a significant portion of the losses in H1; the sharp rise of unemployment is temporary and in the end of the year the US GDP decline would be only -1.2%. The main factor determining the V-shape recovery would be the lack of “psychological hangover” – consumers are no longer afraid to go out and spend, are eager to fly on airplanes and the business is willing to reinvest, after a period of defensive behaviour.

However, the authors note that this development is not very likely (around 30%) and pay more attention to the more likely scenario – a U-shaped recovery (55%).

U-shaped

In this case Greenberg and Seydl forecast a decline of -3.2% of the US economy and return to the pre-coronavirus pandemic economic levels in 2022. This scenario provides for a slower recovery where the H2 2020 growth would not be sufficient to compensate for the sharp contraction of the first six months. Unemployment would also start dropping, but at a slower pace than in the most optimistic scenario.

Again, one of the major factors would be the consumer behaviour and the willingness to return to “life as it was before the coronavirus”. Unlike the most optimistic but least likely scenario, in this variant people would remain cautious for a very long time and will avoid big spending, eating out, travelling and attending big events with lots of people.

But even then, the two analysts expect the economy to recover faster than from the previous big crisis of 2008-2009 and much faster than from the Great Depression. This would be due mainly to the fact that the current crash is caused by an external shock – the coronavirus, rather than by internal problems of the financial system or a recession.

L-shape

According to Greenberg and Seydl, the L-shape recovery is the most pessimistic scenario and the probability of it happening is around 15%. In it the situation with the coronavirus cannot be kept under control – every time the restrictions are loosened, follows a new major outbreak, and the development of an effective vaccine is at least a year away. In this case the economy sustains prolonged and heavy damage, unemployment remains high for a few years and corporate bankruptcies are not unlikely. The authors describe this scenario as “depression” and postpone the recovery for after 2022.

Scenarios and markets

Greenberg and Seydl also discuss the effect of the various scenarios on the markets.

According to them, even the most optimistic V-shape scenario will not have a miraculous effect and yields from investments would hardly rise significantly anytime soon. The budget deficits and the big government spending would not affect the markets, at least until the economies are “fully open”, as the governments “recycle” the cash flows from the private sector into the public sector, mainly in healthcare. Significant inflation factors like rent and consumer good prices will also be pushed down, as rising unemployment means falling consumption and, even though some consumer good prices currently are higher, they won’t last long.

However, the two authors note that in all scenarios the markets will recover before the economy, without overruling further temporary declines. “To be sure, V- and U-shaped outcomes could see further pullbacks ahead, but we think stocks are unlikely to retest lows in these scenarios. An L-shaped outcome would likely lead to further market downside, but even then, we think the probability is quite low, given the significant degree of policy accommodation already injected into the system,” note Greenberg and Seydl, adding that at present there are good opportunities for investments which could provide yields in the future.

“No matter the shape of the gradual recovery, we are finding value in asset classes and securities that haven’t seemed particularly interesting in quite some time,” they said.

Obviously, bad times lie ahead and it is very hard to make a precise forecast how and when this decline will end. But, as the saying goes: prepare for the worst and hope for the best.