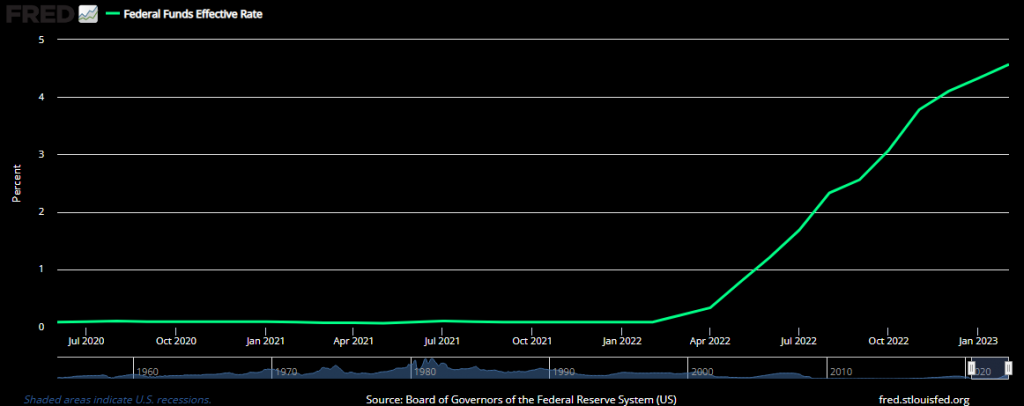

The prolonged period of low interest rates has led to banks operating in a certain way, and now that rates are rising, certain banks are finding it difficult to adjust. This was highlighted by the recent announcement from Silicon Valley Bank (SVB) that it is insolvent.

The impact of rising interest rates is also evident in the value of banks’ assets, which have eroded due to the rapid rise in rates engineered by the Federal Reserve. Additionally, banks are having to compete more fiercely to keep depositors from defecting, which means they have to pay more to keep customers in place. In some cases, banks are forced to sell off low-yielding assets at deep discounts to pay off depositors, which can be especially challenging for smaller regional and community banks.

As the Federal Reserve continues to raise the federal funds rate, the impact on the financial industry is likely to become more pronounced. One of the primary concerns is that the sharp increase in the Fed funds rate is bound to start rooting out some of the weaker players in the industry. Companies that have been heavily reliant on low interest rates may struggle to adapt to the new environment

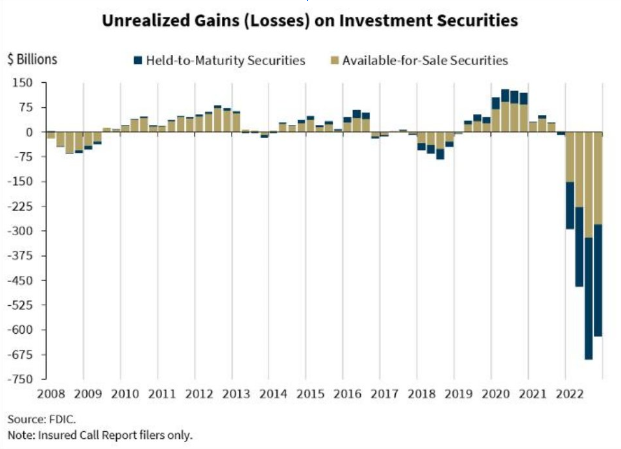

In February, the Federal Deposit Insurance Corp. reported that U.S. banks’ unreleased losses on available for sale and held to maturity securities totalled 620 billion USD as of Dec. 31, 2022, up from 8 billion a year earlier, before the Fed began to raise rates. Unfortunately, more up to date statistics are not available, but the losses might currently be larger.

The recent collapse of SVB highlights the risks inherent in the financial industry, particularly when it comes to mismanagement of risk. Despite the regulatory measures put in place to prevent such failures, some institutions have still fallen victim to the allure of risky investments and speculative practices. A closer examination of SVB’s financial statements reveals a portfolio that was heavily mismanaged.

This is a worrying sign, as it suggests that the bank may have been engaging in irresponsible behaviour that placed the institution and its clients at significant risk. The question that arises from SVB’s actions is whether this is an isolated case of incompetence or if it is indicative of wider moral hazard at play within the financial industry. The fact that some policymakers have been willing to bail out failing banks in the past may have contributed to a sense of complacency among some financial institutions.

Furthermore, the regulation of the financial industry has led to an influx of bonds on the banks’ balance sheets. While this has reduced credit risk for banks, it has also exposed them to interest rate risk. As interest rates rise, the value of bonds falls, potentially leading to significant losses for banks holding these securities.

That’s why banks hedge and enter into an interest rate swap. In this case, the bank pays a fixed yield and receives variable payments in exchange. This strategy can help offset the potential losses resulting from rising interest rates and allows the bank to manage its risk exposure more effectively.

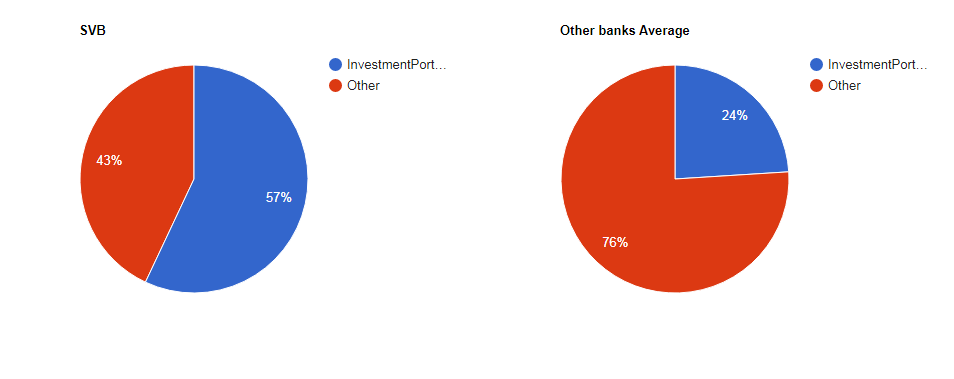

SVB had a significant investment portfolio that accounted for 57% of its total assets, which was well above the industry average of 24% for U.S. banks. Furthermore, an overwhelming majority of the portfolio, roughly 78%, was invested in Mortgage-Backed Securities (MBS). This concentration in MBS was particularly risky, given the history of the U.S. housing market and the potential for significant losses if the market were to experience a downturn. In comparison, larger banks like Citigroup or JPMorgan Chase had more diversified portfolios, with MBS accounting for only around 30% of their investment portfolios.

What’s shocking is that SVB did not engage in any hedging strategies to mitigate its interest rate risk. Oh, and their Chief Administrative Officer was Lehman’s former CFO.

SVB also used some interesting accounting tricks and it did not do this by mistake.

Investments in HQLA can be accounted for under two different methods: Available For Sale (AFS) or Held To Maturity (HTM). Under the AFS method, unrealized gains or losses on investments do not impact the bank’s Profit and Loss (P&L) statement but are reflected in its capital. Alternatively, if bonds are booked as HTM investments, gains or losses will not show up on the bank’s financial statements at all. It is highly unlikely that booking $90 billion of unhedged bonds as HTM investments was a mistake or due to incompetence. This represents an outrageous use of accounting practices.

Financial regulators are discussing two different facilities to manage the fallout from the closure of SVB. Currently there are rumours that HSBC might buy the bank.

What needs to be mentioned is that most of the companies affected by the SVB bankruptcy are start-ups and tech companies. The ones that have disclosed exposure with SVB:

– Circle: $3.3 billion

– Roku: $487 million

– BlockFi: $227 million

– Roblox: $150 million

– Ginkgo Bio: $74 million

– IRhythm: $55 million

– RocketLab: $38 million

– SangamoTherapeutics: $34 million

– LendingClub: $21 million

– Payoneer: $20 million

As of the time of writing, it appears that the Federal Reserve is planning to take extraordinary measures by allowing banks to access its discount window to backstop their operations. The discount window is a lending facility that allows banks to borrow money from the Federal Reserve at a discounted rate. This move is designed to provide support to the banking sector and to mitigate the potential risks of a financial crisis. By allowing banks to turn assets that have lost value into cash without incurring losses, the Federal Reserve is providing a lifeline to the banking sector. This measure can help to boost confidence in the financial markets and prevent a liquidity crisis from escalating into a solvency crisis. Typically, banks are hesitant to use the discount window because of the stigma attached to borrowing from the Federal Reserve. However, in times of financial stress, the discount window can be a crucial source of liquidity.

Although recent events may seem concerning, it is premature to say whether or not we are on the verge of a new financial crisis. While there are certain risks and challenges facing the U.S. financial system, it is important to keep in mind that the current situation is different from the conditions that led up to the 2008 financial crisis. Hopefully, banks and regulators have learned their lesson.

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

76% of retail investor accounts lose money when trading CFDs with this provider.