In recent times, there have been fascinating developments as China intensifies its efforts to challenge the dollar and establish the yuan as a global currency, also known as the PetroYuan. This shift in power dynamics is marked by several significant events that we will explore in this analysis.

One of the key developments is the upcoming building of a major refinery and petrochemical complex in China, led by the Aramco Joint Venture HAPCO. Slated to begin construction in the second quarter of 2023, when completed, this project will see Aramco supply China with up to 210,000 barrels of crude oil feedstock per day.

Moreover, Saudi Aramco is set to further expand its presence in China by acquiring a 10% stake in Rongsheng Petrochemical. This deal involves the placement of 480,000 barrels per day of crude oil to China’s largest integrated refining and chemicals complex. The partnership between Rongsheng Petrochemical Co and HAPCO will result in Aramco supplying a total of 690,000 barrels per day of crude oil to high chemical conversion assets.

In a move to reduce reliance on the U.S. dollar, Saudi Arabia recently announced its intention to enter a trade alliance with China, Russia, India, Pakistan, and four Central Asian nations. This development is significant as China and Brazil have agreed to settle trades in their own currencies, bypassing the U.S. dollar. Additionally, China and France have completed their first liquified natural gas (LNG) trade using the yuan.

Russia is also considering, and most likely will adopt, the yuan as a reserve currency. Meanwhile, Japan has started purchasing Russian crude oil above the $60-a-barrel cap, breaking with Western allies, thanks to an exception authorised by the United States. As European nations reduce their dependence on Russian oil following the invasion of Ukraine, Japan has increased its purchase of Russian natural gas.

In addition to challenging the dollar’s dominance through the rise of the PetroYuan, China has been actively investing in Africa, effectively expanding its influence and strengthening economic ties in the region. These investments span a wide range of sectors, including infrastructure, telecommunications, energy, and agriculture. By fostering mutually beneficial relationships with African nations, China is able to access valuable resources which most likely they will not sell in dollars.

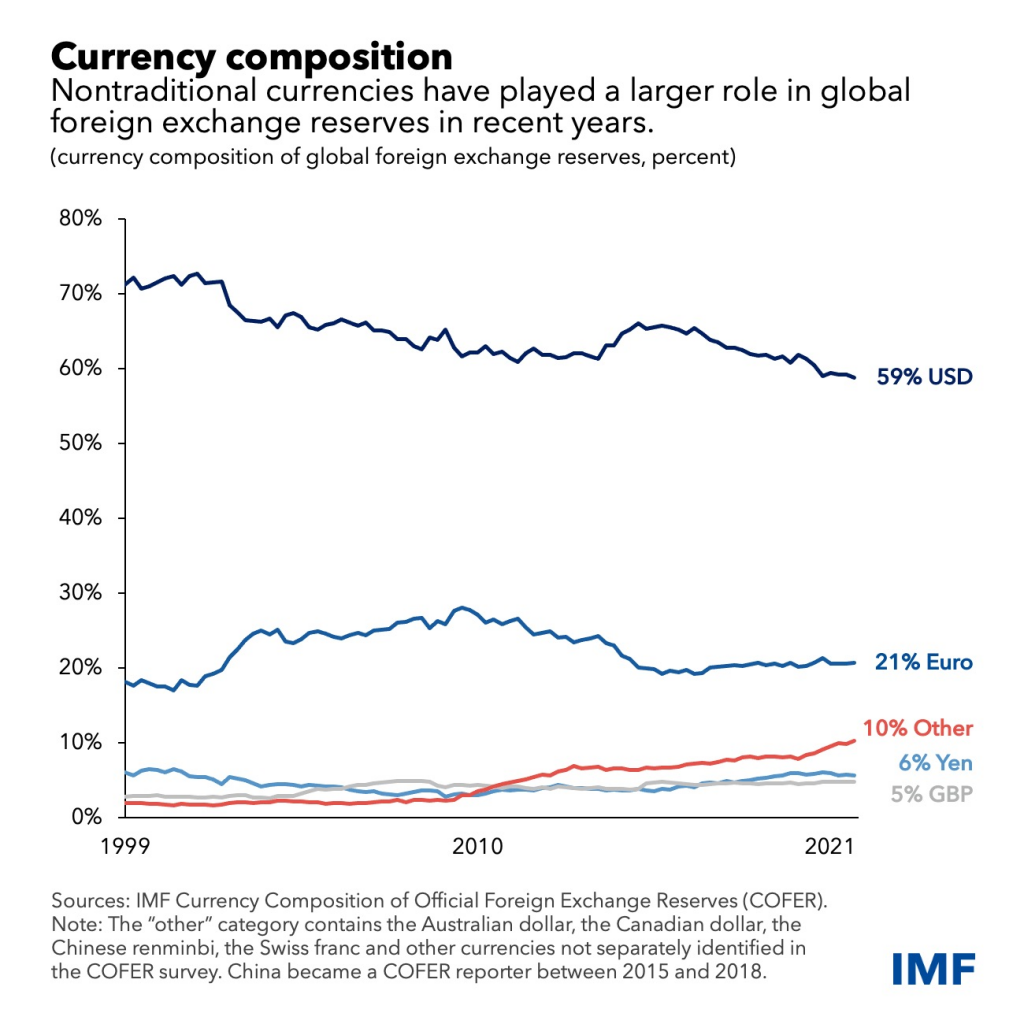

This diversification of global trade relationships is not only helping China establish itself as a key player in international markets, but also contributing to a gradual reduction in the prominence of the U.S. dollar. As more countries engage in trade with China and enter into agreements that favour the use of the yuan, it becomes increasingly likely that the U.S. dollar’s long-held position as the dominant global and reserve currency will be challenged. This shift in currency dynamics has the potential to reshape the global economic landscape.

Although these developments suggest that the dollar’s role in global trade may be gradually diminishing, it’s important to note that such changes take time. The transition to a new global currency involves numerous complex factors and will not occur overnight.

Source: IMF

The final development worth monitoring is the recent announcement by multiple OPEC nations regarding oil production cuts totaling over 1 million barrels per day (bpd). In addition, Russia has also reduced its production by 500,000 bpd. With the U.S. emergency oil reserve now more than halfway depleted, the move suggests a coordinated action against the U.S. interests and sends a strong signal that something significant is brewing in the global energy market.

While this is certainly not game over for the U.S. dollar, it is certainly game ON!

Ivailo Chaushev,

Chief Market Analyst at Deltastock

Risk warning:

This article is for information purposes only. It does not post a buy or sell recommendation for any of the financial instruments herein analysed.

Deltastock AD assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon the information on this page.

76% of retail investor accounts lose money when trading CFDs with this provider.