Source: Depositphotos | Creator: dima4to@gmail.com

Reading time: 4 minutes

In the world of market opportunities, Warren Buffett is somewhat of a living legend. But that title is not just for show. As a more recent example, the net worth of Berkshire Hathaway’s famous owner skyrocketed past the $100 billion mark back in March 2021 at a time when most businesses and investors all over the globe were struggling to make ends meet.

So, how did he do what others could not?

In this article, we’ll look at 3 tips that the “Oracle of Omaha” recently shared which we think will help you on your journey towards achieving financial independence.

1. Consider adding the S&P to your portfolio

“Be fearful when others are greedy, and greedy when others are fearful.”

Warren Buffett

The S&P 500 index (US500 in Delta Trading) is among Mr Buffett’s favourite investments, and for a reason: an already leading financial benchmark, the US500’s growth has absolutely exploded at the dawn of the COVID-19 pandemic and it is still going strong. Just for reference, the index surged as much as 16% back in 2020 and has hit new heights on multiple occasions throughout 2021.

Image: price chart of US500 for 11.2020 – 10.2021 | Source: Deltastock

In fact, the billionaire business guru is so adamant in his position that he had famously instructed his wife to invest 90% of the inherited funds upon his death into a US500 fund. So, if one of the most famous investors alive is behind on such an investment, maybe it’s not such a bad idea for investors to include it in their portfolios as well, if they haven’t already.

Want to be like Warren Buffet, but don’t want to invest actual money just yet? Test your trading strategies in a real market environment for free, without risking any real funds.

2. Stay clear-headed (especially now)

“It’s only when the tide goes out that you discover who’s been swimming naked.”

Warren Buffett

With Elon Musk hyping cryptocurrencies through the roof, the rise in popularity of NFTs, Reddit “stonks” (looking at you Gamestop) and other market shenanigans going on this year, it’s easy to get carried away in excitement and make critical judgement errors that could cost you your hard-earned money.

It’s then very difficult to argue with Mr Buffett’s position of “taking a long-term, practical approach to the market rather than making 30 or 40 trades a day to profit from what looks like a very easy game.” Sure, you may turn in significant profits in the beginning, but considering the fact that the world is still in the grips of a global pandemic, is the risk of investing in the latest trend really that justified? Instead, the businessman argues that a much better idea would be to do your research and make an informed long-term choice.

To illustrate this, during one of his investor meetings, the BRK/B owner showed two slides: one of the 20 biggest global companies by stock value in 1989 and one with the top companies right now. The conclusion was sobering – none of the 1989 companies made it on the 2021 list!

3. Forget about retirement – invest now

“The pension situation is terrible in a great many states. . . . It has not gotten better at all, obviously.”

Warren Buffett

It was no secret before that no pension plan was perfect and this became even more apparent with the onset of the global pandemic. Today, regardless if you’re living in the U.S., Europe, or elsewhere, chances are that you have already felt the negative impact of the pandemic on your pension or will feel them in the future.

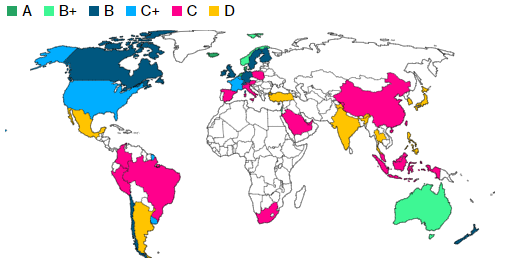

According to the Mercer CFA Institute Global Pension Index, just in 2021 alone, the ongoing pandemic lowered the pension scores of 11 countries, including India and Korea. The institute concluded that this was due to the “current economic environment with reduced wage growth, historically low interest rates and shrinking returns in many asset classes”, all of which are “placing additional financial pressures on existing retirement income systems”.

Image: ranking of global pension plans (A=best; E=worst) | Source: Bloomberg

More and more, it seems that the dream of early retirement is increasingly slipping through the fingers of current and future generations. So, what’s the alternative?

According to Warren Buffet, the solution is to take full control over your financial situation and invest your money into a viable asset portfolio as early as possible, which now also includes farmland. Yes, you read this right – according to data from the investing platform FarmTogether, the average return rate on farmland has been estimated to be over 10% for the past 47 years, effectively outperforming most stocks or other types of real estate.

Looking to invest in more traditional forms of real estate? Delta Trading offers CFDs on a real-estate ETF that measures the performance of publicly traded equity real estates.

Final words

In just a year, the status quo on the markets underwent a radical shift and part of the negative consequences from COVID-19 will likely be felt long after the pandemic ends. But while wise people like Warren Buffet are willing to reach out to us through the darkness and teach us how to adapt to the new market environment, nothing is certain and you always need to be ready to instantly react to any economic changes that may be headed your way.

Because, in times of pandemic, the winners of today can easily become the failures of tomorrow, regardless if you invest in benchmark indices or fertile land. That being said, Warren’s tips sound solid and could be used as a starting point in order to build a suitable financial strategy in the years to come.

***

Disclaimer: This article was published for information purposes only. It does not represent a buy or sell recommendation for any of the financial instruments herein mentioned. The information is obtained from generally accessible data sources and media.